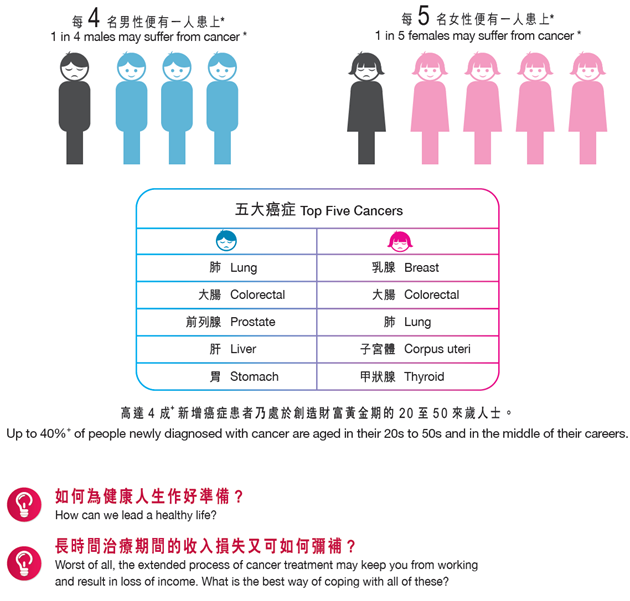

The numbers are significant. The risk of Cancer should not be underestimated.

Cancer is no doubt the biggest threat to our health, but thanks to the advances in medical science, the cure rate has been improving. New developments are being seen not only in the diagnosis but also in the treatment of cancer, with innovative medication and equipment being increasingly used. The key therefore to receiving the prompt and quality treatment is to have adequate financial support.

* Percentage of Hong Kong people developing cancer before the age of 75, according to Hong Kong Cancer Registry, Hospital Authority (2013).

+ The average percentage of cancer patients aged from 20 to 59 among all age groups, according to 2009-2013 Hong Kong Cancer Statistics, Hong Kong Cancer Registry, Hospital Authority (published December 2015).

MassMutual Asia's Extra Cancer Care offers you all-round protection as it covers Carcinoma-in-situ, Early stage and Later-stage Cancers. Best of all, the plan not only reimburses the actual medical expenses but also provides extra care and monthly living benefit, to give the support you need so that you can enjoy absolute peace of mind during recovery.

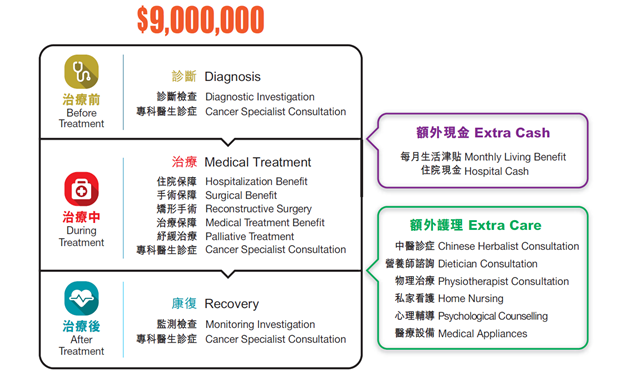

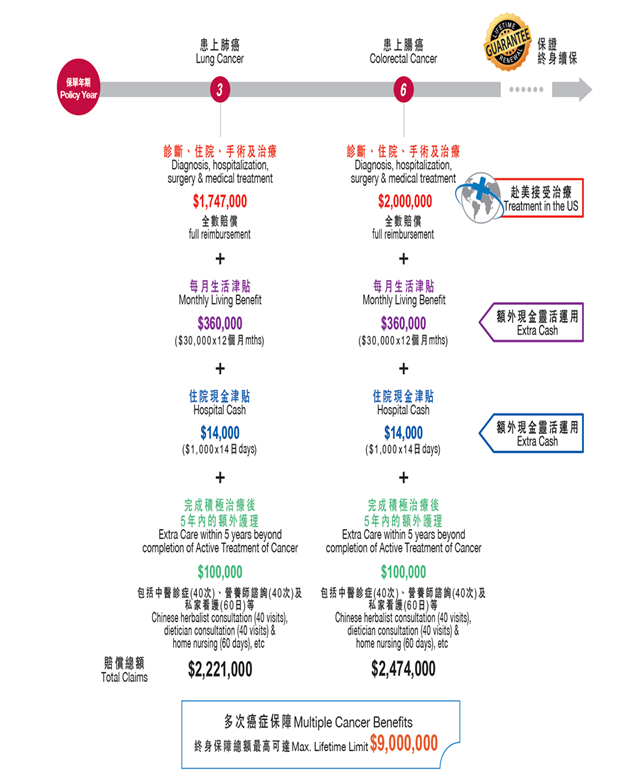

Comprehensive Benefit up to $9,000,000

Extra Cancer Care provides the most comprehensive cancer benefit, from diagnostic investigation and medical treatment to ongoing monitoring after treatment. The plan offers a maximum lifetime limit of as much as HK$9,000,000, with full reimbursement1 of the actual medical expenses for diagnosis and treatment. On top of this, the plan offers an array of extra care and cash benefits.

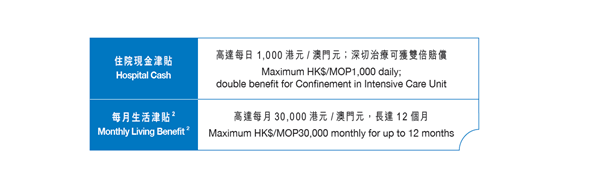

Extra Cash Benefit

Unlike other plans available in the market, Extra Cancer Care provides you with two more cash benefits. You can spend the cash at your total discretion to cover the loss of income as well as the extra expenses.

Worldwide Coverage Lifetime Guaranteed Renewal

The plan provides worldwide coverage3 and lifetime guaranteed renewal, with a benefit term of up to age 100 of the Insured. The annual renewal premium will be adjusted based on the attained age of the Insured and at the premium rate in effect of the same level of benefit at the time of renewal.

Multiple Cancer Benefits

The plan provides comprehensive coverage in case of multiple Cancers.

• Provided that the period elapsed between the diagnosis dates of the two different Cancers (whether they occur in the same or a different organ) is one year or more, the subsequent Cancer is considered as another Cancer.

• If the subsequent Cancer is a recurrence or metastasis of the Relevant Preceding Cancer, provided that the period elapsed between the diagnosis dates of the subsequent Cancer and the Relevant Preceding Cancer is five years or more, and the Relevant Preceding Cancer was once in complete remission during such period, the subsequent Cancer is considered as another Cancer.

• Otherwise, it is considered as a continuation of the Preceding Cancer ,i.e., the benefit will be paid under the same Cancer.

A Plan for your Precious HealthBenny is fully aware of the adverse impact that cancer may have on both health and wealth. Therefore, he insured with an Extra Cancer Care - Prestige policy at age 35. In the unfortunate event of being diagnosed with cancer, he will be backed by sufficient financial support to receive prompt and quality medical treatment, leaving his family free of major financial burden.

|

|

Remarks: The above example is based on the assumption that the Insured is diagnosed with two different types of Later-stage Cancer. The medical expenses are hypothetical, which are provided by a medical specialist and with reference to the fees charged by private hospitals. The above example is for reference only. Actual fees depend upon the actual medical condition, medication, fees charged by attending doctors and hospitals, etc.

Note

1 Reimbursement will be based on a "Reasonable and Customary" basis, i.e., treatment and procedures that are Medically Necessary and do not exceed the general level of charges at the location for such treatment and procedure.

2 Applicable to the first diagnosis of a Later-stage Cancer and while the Insured

is still alive.

3 The maximum aggregate benefit payable for Cancer treatment charges incurred in the US including Hospitalization Benefit, Surgical Benefit, Medical Treatment Benefit, as well as the Medical Consultation and Diagnostic Benefit for all Extra Cancer Care and Extra Cancer Benefit issued by the Company under the same Insured will be up to HK$2,000,000 Per Cancer.

4 For Confinement of ward type above semi-private room, the benefit payable under Hospitalization Benefit, Surgical Benefit, Medical Treatment Benefit,

Diagnostic Investigation and Monitoring Investigation during such period will be reduced to 50%.

5 The benefit payable includes but not limited to Cryosurgery, Laser Surgery, Photodynamic Therapy and Radiofrequency Ablation.

6 Covers only Diagnostic Tests directly confirming the positive diagnosis of Cancer.

7 Active Treatment of Cancer means any treatment prescribed by or administered under the supervision of a Cancer Specialist to treat Cancer using interventions including but not limited to Chemotherapy, Radiotherapy, Target Therapy and surgery, etc (excluding any treatment given solely as Palliative Care).

8 MediNet Pro is provided by Inter Partner Assistance Hong Kong Ltd. The current administration fee for each Second Medical Opinion is HK$/MOP500. For each referral to medical treatment in the USA, the current administration fee is US$500. The Insured is also responsible for paying the administration fee and for any medical treatment and other related costs in the USA. Inter Partner Assistance Hong Kong Ltd. reserves the right to review the price and the number of hospitals from time to time without prior notice.

9 If the benefit is payable under Hospital Cash for Confinement in Intensive Care Unit, no Hospital Cash will be paid.

This brochure contains general information, is for reference only and does not form part of the po licy. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555, Macau (853) 2832 2622.