When making investments, proper risk management is key to an enjoyable retirement. MY Lifetime Annuity is the solution for optimizing asset allocation, diversifying risk and accumulating wealth. Best of all, it provides guaranteed annuity income for life.

MY Lifetime Annuity

The most important features for your ideal annuity plan are...

Stable Wealth Accumulation

- Optimize asset allocation and diversify investment risk for stable portfolio returns

- During the accumulation period, interest is credited at a compound rate, so that you can enjoy the power of “snowball effect” to compound your wealth in Account Value over time

- The plan also offers Guaranteed Special Bonus 1, Extra Bonus and long-term guaranteed interest 2

Guaranteed Lifetime Annuity Income

- The plan is a genuine lifetime annuity plan, offering you guaranteed lifetime annuity income that is not widely available in the market

- The Insured is free to decide when to start receiving the annuity income 3 and enjoy the maximum flexibility

- During the annuity period, even if the Insured lives until 100 years old or even longer, the plan guarantees lifelong income and effectively hedges the financial impact of longevity risk

Guarantee Your Most Loved Ones can Inherit Your Wealth

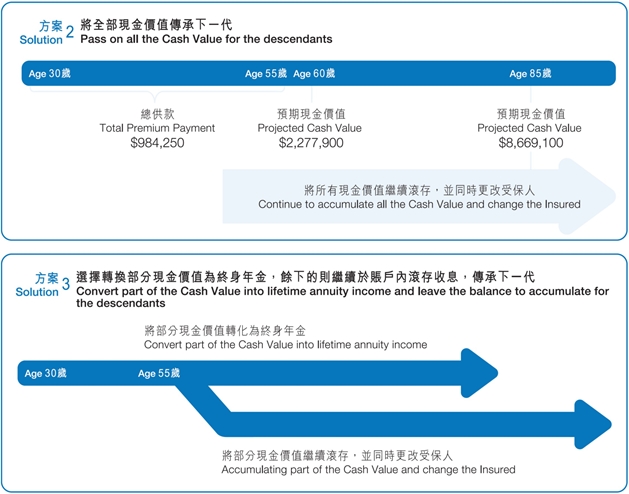

- The Policy Owner may apply to change the Insured 15 while the policy is in force so as to pass on the accumulated wealth to his/her loved ones or descendants. There is no limit on the number of changes allowed.

- No need to wait for completion of probate and may enjoy certain tax advantages ^

- Avoid costly trustee fees

- Changing the Insured will not affect the Cash Value of the policy

- Your next generation can also enjoy the annuity options

^ Change of policy owner may also be required. Please consult with your own legal advisors in respect of the taxation of an individual country or region.

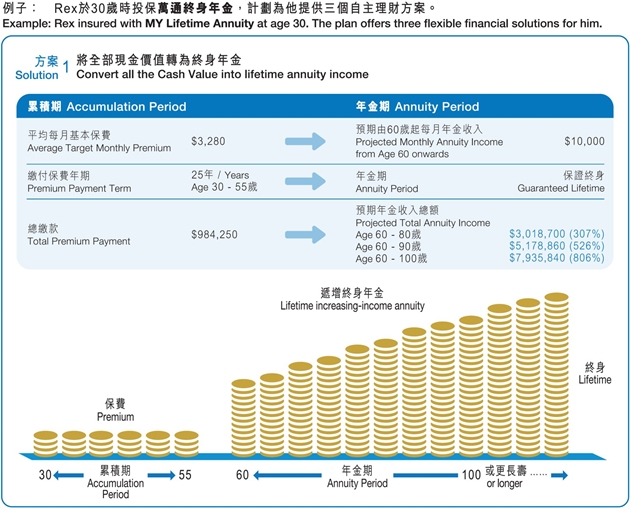

The above example is based on a male customer insured with MY Lifetime Annuity. The target premium is paid annually and the figures for the target yearly premium and total premium payment are rounded to the nearest ten dollars. The figures illustrated are based on the current assumed crediting interest rate of 4.5% p.a. (including the current assumed base crediting interest rate of 4% p.a. and the current assumed retrospective additional interest rate of 0.5% p.a.), Guaranteed Special Bonus, current assumed Extra Bonuses, premium paid in full during the premium payment term, and current scale of charges for the plan. The current assumed crediting interest rates are not guaranteed and do not represent the upper or lower limits of the actual rate to be declared. The current assumed crediting interest rates are for reference only. The annual annuity income is calculated based on the accumulated Cash Value, lifetime increasing-income annuity option, and current assumed annuity rate. The annuity rate is calculated based on the mortality rate, annuity interest rate, expenses, etc. The actual annual annuity income will be calculated based on the annuity rate in effect on the annuity date.

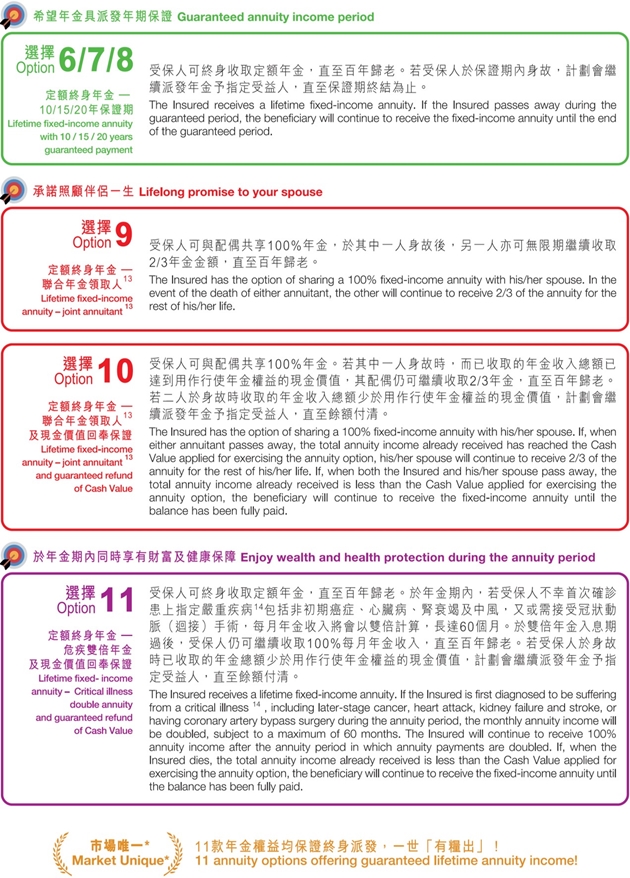

11 Annuity Options

The plan offers the most comprehensive annuity options in the market. The Insured may choose the annuity option 12 based on his/her personal, family or financial needs.

* Based on the deferred annuity plans in the market, as of the print date of this brochure in July 2018.

Financial Flexibility

- Flexible premium payment terms – the plan offers various premium-payment-term options, from 5 years up. A singlepremium payment option is also available.

- Flexible financials – when your policy has accumulated a Cash Value 4 sufficient to cover the monthly charges, you may withdraw a portion of the Cash Value 5 , exercise the automatic periodic withdrawal option 6 or temporarily skip premium payments 7. The plan also offers you the flexibility to increase the Target Yearly Premium 8 to reach your retirement targets earlier.

- Flexible asset allocation – you may convert the entire Cash Value into annuity income, or convert part of the Cash Value into annuity income and leave the balance to accumulate in the policy for your descendants. You may also leave the entire Cash Value for your descendants.

Worry-free Protections

The plan also offers you an array of extra protections for you and your family:

- Death Benefit – Guaranteeing Refund of Capital 9

- Terminal Illness Benefit 10

- Free Accident Waiver of Premium Benefit 11

Remarks:

1 For regular-premium policies, Guaranteed Special Bonus will be credited for every increase in Target Yearly Premium of the Basic Plan at the end of the 10th and 15th year after the effective date of such increase, with an amount equal to 30% of the respective increase in Target Yearly Premium of the Basic Plan. If the Target Yearly Premium of the Basic Plan is reduced before the Guaranteed Special Bonus is credited, the Guaranteed Special Bonus will be reduced proportionally. For single-premium policies, Guaranteed Special Bonus will be credited for every payment of unscheduled premium at the end of the 10th year after the effective date of such unscheduled premium, with an amount equal to 5% of the respective unscheduled premium. If any cash withdrawal amount or Cash Value applied for exercising annuity option exceeds the encashment limit before the Guaranteed Special Bonus is credited, the Guaranteed Special Bonus will be reduced.

2 The Account Value (including the total interest, Extra Bonus and Guaranteed Special Bonus credited to the policy) is guaranteed to have accumulated to an amount at least as if the interest rate credited had been 3% p.a., provided that the policy has been in force for 15 years or more.

3 Upon reaching the age of 55 and the 10th policy anniversary, the Insured is free to decide on the annuity date. Current requirement on minimum Cash Value

applied for exercising annuity option is US$10,000 or HK$/MOP80,000.

4 Cash withdrawals or skipping premium payments will affect the accumulation of the Cash Value, while the monthly charges are still deductible. If the Cash Value is insufficient to cover the monthly charges, the policy will lapse with zero value.

5

For single-premium policies, the balance of the Account Value after withdrawal must not be less than US$5,000 or HK$/MOP40,000. If cash withdrawals do not exceed the encashment limit (i.e., the Account Value prior to the cash withdrawal minus 50% of the initial single premium and all unscheduled premiums paid within the past 60 months before the withdrawal is made), or the withdrawal is made 5 years after the last premium is paid, no surrender charge will be applied. “Cash Value” means the Account Value less the applicable surrender charge. You are entitled to receive the Cash Value at the time of policy surrender, or withdraw a portion of the Cash Value to cope with emergencies.

6 Automatic periodic withdrawal option is only applicable if the policy has been in force for at least 10 years, and the withdrawal charge will be waived. Current requirement on minimum monthly withdrawal amount is US$500/HK$/MOP4,000, with minimum withdrawal period of one year; the minimum annual withdrawal amount is US$6,000/HK$/MOP48,000, with minimum withdrawal period of three years. For any change after the application has been confirmed, a nominal fee of US$25/HK$/MOP200 will be levied.

7 Though this plan provides you with some flexibility in premium payment, you should have every intention of paying the premium for the whole of your chosen Premium Payment Term.

8 The Target Yearly Premium of the Basic Plan may be increased before the Insured reaches age 70 provided the Premium Payment Term still has at least 5 years to run, or you may credit a lump-sum unscheduled premium to a single-premium policy before the Insured reaches age 70.

9 If the death of the Insured occurs before exercising an annuity option with the full Cash Value, Death Benefit will be paid to the policy beneficiary. If the death of the Insured occurs during the Premium Payment Term or within the first 5 policy years of a single-premium policy while the policy is in force, the total premiums paid for the basic plan (net of any cash withdrawal amount and the Cash Value applied for exercising annuity option), or 101% of the Account Value, whichever is higher, will be paid to the policy beneficiary. If the death of the Insured occurs after the end of the Premium Payment Term or after first 5 policy years of a single-premium policy, a death benefit equal to 100% of the Account Value or total premiums paid for the basic plan (net of any cash withdrawal amount and the Cash Value applied for exercising the annuity option), whichever is higher, will be payable.

10 On the first occasion that the Insured is diagnosed with a Terminal Illness before exercising an annuity option with the full Cash Value, advance payment of the Death Benefit of the basic plan and of any supplementary benefits (if applicable) will be paid to the Insured. Terminal Illness means a disease of the Insured, which in the opinion of our appointed medical consultant is likely to lead to death of the Insured within twelve months. Upon payment of the Terminal Illness Benefit, the related policies and all the supplementary benefit(s) attached will automatically be terminated. Please refer to the policy document for the relevant terms and conditions.

11 Not applicable to single-premium policies. In the event that the Insured suffers total disability due to accident for a continuous period of not less than 6 months before the age of 65, all subsequent target premium payments of the basic plan will be waived as long as the Insured remains totally disabled, up to US$10,000 or HK$/MOP80,000 annually (on a per-life basis).

12 Each Insured can exercise annuity option once only. The availability of the annuity option 1 “Lifetime fixed-income annuity” is guaranteed. We reserve the right to determine the annuity options available for this plan from time to time.

13 Current requirement of the age of spouse when exercising this annuity option is 40 or above.

14 Not applicable to critical illnesses occurred before the annuity date, or signs and symptoms which existed before the annuity date.

15 The Policy Owner may change the Insured after the 1st policy year. All supplementary benefit(s) (if applicable) will be terminated upon the effective date of the change of Insured. Please refer to the policy document for the relevant terms and conditions.

16 The current assumed crediting interest rate (including a current assumed base crediting interest rate, a current assumed retrospective additional interest rate) and Extra Bonus rates are quoted as of the print date of this pamphlet in July 2018, and are not guaranteed. The rates are subject to change.

The above contains general information, is for reference only and does not form part of the policy. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555, Macau (853) 2832 2622.