In late June 2017, the Insurance Authority (IA) took over the regulatory functions of the Office of the Commissioner of Insurance to act as the HKSAR’s insurance regulator independent of both the Government and the insurance industry. During the initial stages, the costs for establishing and operating IA are being covered by government funding, but over the long term, IA has to be financially independent and recover its operating costs by a statutory premium levy on policy owners, insurance companies, insurance intermediaries, and specified service users.

In accordance with the Insurance (Levy) Regulation and the Insurance (Levy) Order under the Insurance Ordinance, commencing January 1, 2018, the IA will impose a levy on all new and in-force insurance policies# issued in Hong Kong. Thus, policy owners will be required to pay the levy together with their premiums payable to the relevant insurance companies, who will then transfer the levy to the IA. For details about the levy, please visit the dedicated IA webpage at www.ia.org.hk/en/levy .

# The levy is NOT applicable to paid-up policy(ies).

Calculation on Levy

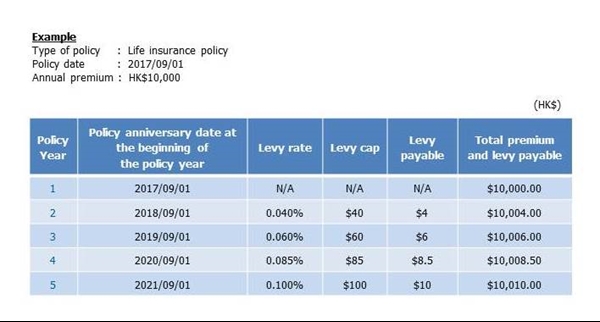

The amount of the levy imposed on each policy will be calculated based on the percentage of premium payable and the levy cap per year. In Phase 1, the levy rate imposed by IA will start at 0.04% of the insurance premium, and increase gradually until it reaches 0.1%. In Phase 1, the cap level for life insurance policies and general insurance policies will be HK$40 and HK$2,000 per year respectively, and in subsequent phases the levy cap will be adjusted gradually upward. Details of levy rates and cap levels are shown below:

Policy Date / Policy Anniversary Date* |

Levy Rate (% of premium payable) |

Levy Cap(HK$) (per policy per year) |

Life Insurance |

General Insurance |

From January 1, 2018 till March 31, 2019 (both dates inclusive) |

0.040% |

40 |

2,000 |

From April 1, 2019 till

March 31, 2020 (both dates inclusive) |

0.060% |

60 |

3,000 |

From April 1, 2020 till

March 31, 2021 (both dates inclusive) |

0.085% |

85 |

4,250 |

From April 1, 2021 onwards (date inclusive) |

0.100% |

100 |

5,000 |

* Levy rate and cap level of policies are determined by policy date / policy anniversary date. For policies with back-dating arrangement , the applicable levy and cap level shall be determined with reference to the effective date of coverage/

anniversary of the effective date of coverage.

FAQ

1. To which types of insurance policy is the levy applicable?

The levy is applicable to all new and in-force life insurance policies and general insurance policies issued in Hong Kong, including but not limited to, travel, car, property and household insurance (except policies exempted from the levy by law, including reinsurance business, policies underwritten by authorized captive insurers, and marine, aviation, and goods-in-transit business). In respect of levy, most of MassMutual Asia’s personal insurance policies are classified as “life insurance” policies, while most group insurance/employee benefits policies are classified as “general insurance” policies.

2. When will the premium levy take effect?

The levy is required to be paid together with the premiums payable (1) for policies with policy date^ on or after January 1, 2018 or (2) starting from the policy anniversary date^ in 2018.

^ For policies with back-dating arrangement, the effective date of levy collection will be determined by the effective date of coverage/ anniversary of the effective date of coverage.

3. What arrangements will MassMutual Asia make to facilitate clients’ levy payments?

As a transition measure covering the introduction of the levy, MassMutual Asia will pay the required levy amount for premiums received and accepted on or before July 31, 2018 (“the transition period”) on behalf of its policy owners. After this date, all applicable levies will be borne by policy owners. With effect from August 1, 2018, the following procedures will be applied to your policy(ies) (if applicable), unless otherwise specified:

• If a designated autopay account is used to settle premiums, the respective levy will be collected at the same time by autopay.

• If a Premium Deposit Account is used, any unsettled levy will be collected from the Premium Deposit Account when due.

• If a premium is paid by automatic policy loan (APL), the respective levy shall also be paid by APL at the same time and become part of the APL on which loan interest shall be charged.

• The levy will be collected at the time any future premium(s) are prepaid, subject to the respective levy rate and cap.

• In case of reinstatement, the respective levy on overdue premium(s) must also be paid at the time of reinstatement, subject to the respective levy rate and cap.

• Any outstanding levy will be deducted from benefit proceeds in the event of claim/maturity/surrender.

• For flexible premium products (e.g., FLEXI-ULife Prime Saver, Target Lifetime Annuity Saver), the actual premium payment and levy will be based on the amount paid (subject to the prevailing administrative rules), if the amount paid is not the same as the planned premium and corresponding levy.

4. How can I find out when and how much I need to pay?

After the transition period, policy owners can check with their consultant or our customer service officer on the amount of levy required and its due date. Policy owners can also log into the “e-Policy Service” to get the details of the levies related to their policies. In addition, the total amount of premium payable and levy required will be shown in the Premium Notice issued by the Company.

5. Can I pay the levy to IA directly?

No. Under the Insurance (Levy) Regulation, policy owners must pay the levy to the IA through their insurance company.

6. Will my policy lapse if I do not pay for the levy?

No. The policy will not lapse solely due to unpaid levy. In the event of an unpaid levy, we shall inform the policy owner to settle the levy as soon as possible. To ensure we can inform the policy owner about levy-related matters, please inform us as soon as possible about any change in personal information.

7. If I have already paid-up my policy and policy coverage is still in force, is levy payment required?

No.

8. If I settle the premium by autopay, will the levy be debited together with the premium from the same account?

If you use a designated autopay account to settle premium, the respective levy will be collected at the same time by autopay. If necessary, please contact your bank to make changes to your autopay instructions.

9. If a policy owner exercises his/her right to terminate the policy during the cooling-off period, will the levy be refunded along with the premium?

Yes, the paid levy and premium will be refunded to the policy owner. However, if the levy was paid by the Company on behalf of policy owner, the refund will not include the relevant levy.

10. What if a policy owner refuses to pay the levy?

As stated in the law, insurance companies are required to report to IA any levy that remains overdue for more than six months. If a policy owner does not pay the levy as required, the IA may impose on the policy owner a penalty of up to HK$5,000, and may recover the outstanding levy as a civil debt due to IA.