What is your 'prime' choice when preparing for your children's future?

To see one's child to have a great head start is the wish of every parent. However, high-quality education is costly, that's why start planning today is essential.

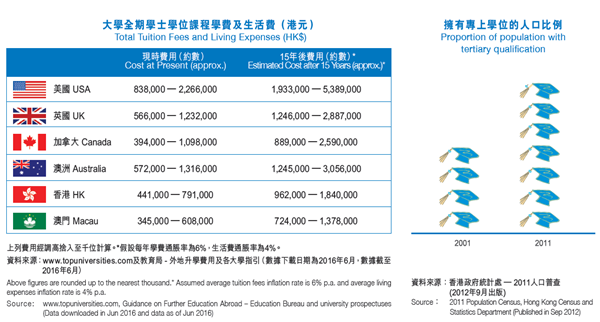

As a matter of fact, the proportion of the population with a tertiary qualification has increased by 80% over the last ten years. This shows that a high-quality tertiary education is imperative in ensuring a promising future for your children. But are you ready to shoulder the significant financial burden involved?

Don't let planning for education leave you in a vulnerable situation...

Nurturing a child is a long-term commitment. Have you ever imagined how your children's future might be affected due to an unfortunate accident spoiling your detailed planning?

-

9.88% of 35-year-old males will die before age 65

-

5.01% of 35-year-old females will die before age 65

-

Hospitalizations due to critical illness are now 380,000 a year on average

-

Accidental deaths and injuries, whether work-related or due to traffic accidents, total some 60,000 a year on average

Source: Hong Kong Life Table (Published in Sep 2015), Hospital Authority Statistical Report 2008-2013 (Published in 2009-2014), Hong Kong Annual Digest of Statistics 2013 (Published in Nov 2014)

MassMutual Asia's FLEXI-ULife Prime Saver Jr. offers you the combined benefits of returns advantages, financial flexibilities and peace-of-mind protections. Most importantly, you may attach a supplementary "Payor's Benefit" rider to ensure the education fund will accumulate according to schedule.

3 Value-creating Advantages

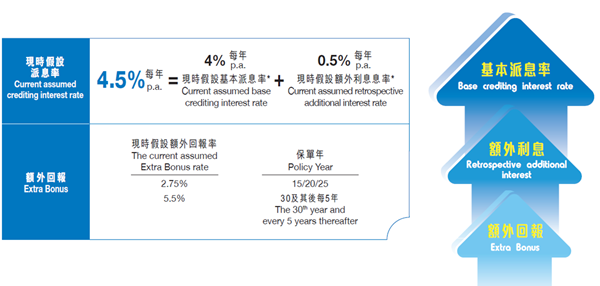

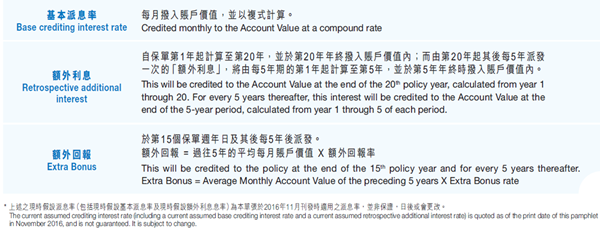

FLEXI-ULife Prime Saver Jr. gives you a relatively higher rate of return than most bank deposits. Your premium will be credited to the Account Value after deduction of any applicable charges. The plan credits interest monthly at a compound rate. Moreover, you will be offered a "retrospective additional crediting interest" and an "Extra Bonus", making the savings for your child's education grow even faster.

In addition, when a policy has been in force for 15 years or more, the total intrest and Extra Bonus credited to the policy will be such tht the Account Value is guaranteed to have accumulated to at least an amount as if the interst rate credited had been 3% p.a., regardless of the economic situation.

Calculation and Payment Method

3 Financial Flexibilities

In order to achieve better interest and returns towards your financial goals to support your children's education, you can make:

|

Flexible Increase of Premium |

| |

| When your policy has accumulated a Cash Value sufficient to cover the monthly charges, you can enjoy the following flexibilities without the need to reduce the Basic Sum Insured: |

| |

|

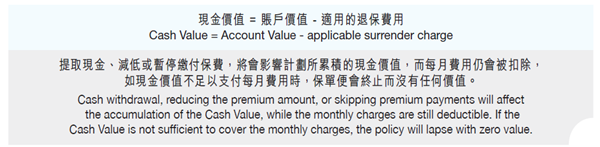

Greater Liquidity |

|

You can exercise the automatic periodic withdrawal option1 to withdraw a specified amount of Cash Value monthly/annually at preset time intervals, so that you can easily map out your financial needs, e.g. children's university education funds and retirement expenses. In addition, you can withdraw a portion of the Cash Value2 at any time to cope with emergencies. |

|

|

|

Skip Premium Payments |

1. Automatic periodic withdrawal option is only applicable if the policy has been in force for at least 10 years, the withdrawal charge will be waived. Current requirement on minimum monthly withdrawal amount is US$500/HK$4,000, with minimum withdrawal period of one year; and the minimum annual withdrawal amount is US$6,000/HK$48,000, with minimum withdrawal period of three years. For any change after the application has been confirmed, a nominal fee will be levied.

2. The current charge for each withdrawal is US$25 or HK$200.

3 Peace-of-mind Protections

3. The "Payor's Benefit" is valid until the insured child has reached age 25 or the policyowner has reached age 65, whichever is sooner.

4. When increasing the Basic Sum Insured, the insured child may be required to prove that he or she is free from HIV infection and/or related conditions, including AIDS, at the same time.

5. Terminal Illness means a disease of the Insured, which in the opinion of our appointed medical consultant is likely to lead to death of the Insured within twelve months. Upon payment of the Terminal Illness Benefit, the related policies and all the supplementary benefit(s) attached will automatically be terminated. Please refer to the policy document for the relevant terms and conditions.

Comprehensive Supplementary Benefits

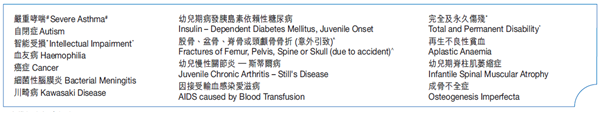

Update Jr. Health Benefit

If the insured child suffers from any of the following pediatric illness, a lump-sum benefit will be paid.

#Benefit amount equals to 20% of the Sum Insured

^Benefit amount equals to 20% of the Sum Insured

*Only applicable to Insured aged 4 or above and caused by sickness or accident.

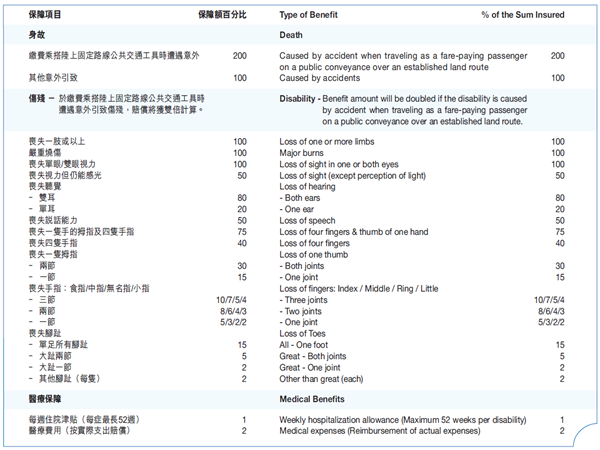

Smart Kids Accident Protector

Comprehensive coverage provides the insured child with lump-sum benefits and reimbursement of medical costs for injury due to accident.

This brochure contains general information and is for reference only and does not form part of the policy. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555.