According to the World Economic Outlook Update published by the International Monetary Fund, Asia is the world’s fastest growing region1.

As one of Asia’s a_uent elites, you have already made distinct achievements in wealth creation. In fact, insurance is an indispensable cornerstone of wealth creation. Not only does it protect our human capital, it also acts as an ideal wealth-creation tool for our loved ones.

That’s why all-round risk-management solutions are effective means of risk diversification that help reduce the overall risk to an investment portfolio.

1 Source : World Economic Outlook Update, International Monetary Fund (April 2016).

Enjoy Special Privileges Exclusive to You

A successful and affluent individual like you aspires to a life less ordinary. Your prestige status thus dictates a solid and highly flexible financial plan, giving you the peace of mind to plan ahead for an exceptional future.

Prestige-ULife Insurance Plans are designed exclusively for those like you who have achieved the high ground, offering full control of your own personalized life insurance plan. The Plans are made available with a minimum Sum Insured of US$1 million, providing you with uniquely high flexibility, and enabling you to live the lifestyle you have planned for.

Flexible Tailor-made Plans for Privileged Individuals

Prestige-ULife frees you from the rigid limitations of traditional life insurance by offering you unmatched flexibility. The Sum Insured, premium amount and even payment periods can be adjusted at any time so as to accommodate changes in your financial situation.

Flexible Coverage

Breaking the fixed-sum-insured rule of traditional life insurance, you can now increase your Sum Insured without applying for a new policy. You simply adjust your existing policy, thus avoiding additional policy charges, leaving you with more cash available for savings.

Exclusive Premium Flexibility

Unlike traditional plans with fixed premiums and payment-period terms, Prestige-ULife allows you to deposit extra premiums at any time to boost your savings and earn extra interest. You may also reduce the premium amount or even skip payments to cope with any financial emergencies without loan interest charges, provided your policy has accumulated a Cash Value sufficient to pay the “Monthly Deductions”. Most importantly, you still enjoy 100% protection.

More Protection Options

To match both your protection and savings needs, Prestige-ULife Supreme provides you with Level Life Protection. Prestige-ULife Plus provides Increasing Life Protection as an additional option, so that you may apply to switch between the two options to better suit your circumstances at every stage of your life1.

1 Any change from the Level Life Protection option to the Increasing Life Protection option is subject to underwriting of the Insured’s health. The Insured must also apply before the age of 65 to take advantage of this option.

Faster Growth with Even Higher Returns

Our goal is to provide you with a steady and promising stream of returns to enhance your enjoyment of the privilege life. MassMutual Asia has thus appointed a team of renowned investment veterans to manage the life fund. Currently, our assets are mainly invested in a prudently diversi_ed portfolio of highly rated bonds and risk-tolerant securities.

Additional Interest Bonus at Compound Rates

Unlike traditional plans that credit dividends once a year, Prestige-ULife credits interest monthly at a compound rate that helps your savings grow much faster. In addition, as a long-term customer, you may reap the “additional interest bonus”1 of 1% p.a. , for a further boost to your Account Value.

2.75% Guaranteed Interest Rate

To give you further security, Prestige-ULife offers you a guaranteed crediting interest rate2, so that the total interest credited to the policy will be such that the Account Value is guaranteed to have accumulated to an amount at least as if the interest rate credited had been 2.75% p.a., giving you further peace of mind.

1 The "additional interest bonus" is applicable from the 21st policy year and thereafter.

2 The "Guaranteed Crediting Interest Rate" is only applicable to a policy that has been in force for 15 years or more.

Flexible Cash Withdrawal

Unlike former plans requiring cash withdrawals to take the form of a policy loan, once the policy has accumulated a Cash Value, you can enjoy the _exibility to withdraw cash without having to pay any loan interest. The withdrawal amount in each policy year can be up to 10% of the Cash Value at the beginning of that policy year. If the cash withdrawal amount exceeds 10%, the extra amount can be withdrawn by reducing the Sum Insured. Moreover, if you need cash for an emergency, you can get instant access to a policy loan of up to 90% of the total Cash Value, which frees you from the hassle of having to raise the cash elsewhere.

Guaranteed Charges

To differentiate itself from traditional plans, Prestige-ULife provides you with the benefit of guaranteed charges. The monthly charges will not exceed the upper limits specified in the policy schedule. You are thus safeguarded with more promising returns on your savings.

Guaranteed Lifelong Protection

To give you further peace of mind, Prestige-ULife Supreme provides you with a no-time-limit protection guarantee. Even if the policy has no Cash Value, the Plan gives you lifelong protection1, provided that the total premiums you have paid, less the accumulated withdrawal amount, fulfill the specified minimum premium amount as scheduled in the policy provisions.

1 The guaranteed lifelong protection up to age 100 is subject to the "Coverage Continuation Test Provision" in the policy provisions.

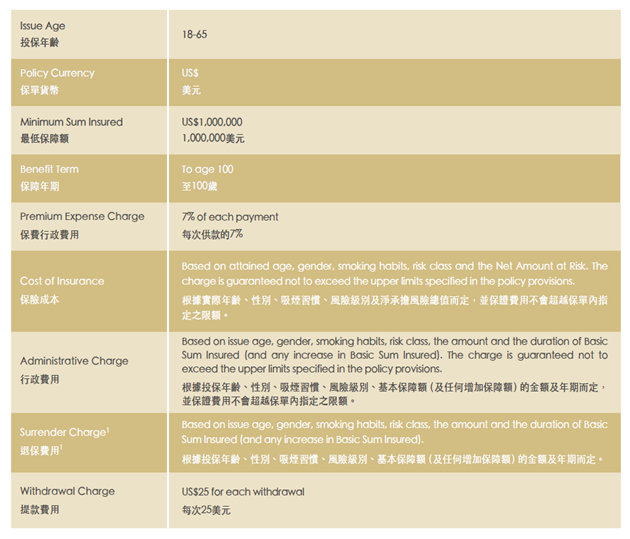

Summary of Plan Features and Current Charges

Click here to enlarge the Summary of Plan Features and Current Charges

1 A surrender charge will be applied within the first 14 years from the effective date of the policy or the effective date of each layer of Basic Sum Insured in the following circumstances: surrender of the policy, decrease in Basic Sum Insured, or cash withdrawal if the withdrawal amount exceeds 10% of the Cash Value at the beginning of each policy year.

This brochure contains general information and is for reference only. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555.