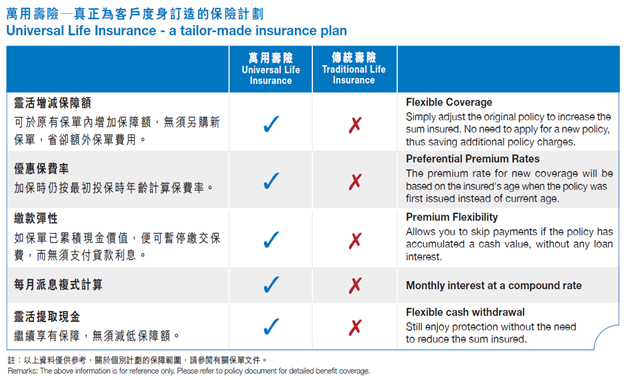

With proper financial planning, you can achieve better wealth creation and enjoy a brighter future. A universal life insurance plan combining high flexibility and value growth is the best solution for your life protection and wealth management.

MassMutual Asia's FLEXI-ULife Prime Saver offers you the combined benefits of flexible coverage, handsome returns and financial flexibilities. What's more, it is tailor-made to cater to your changing needs at different stages of your life.

3 Flexible Protections

3 Value-creating Advantages

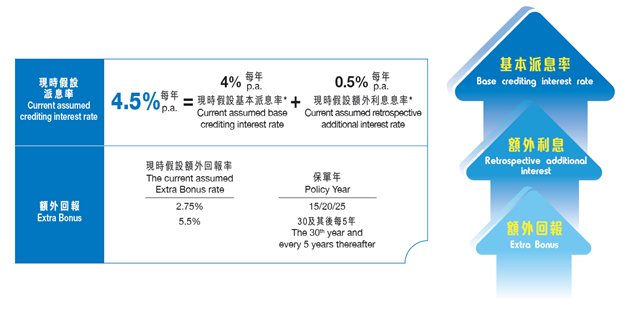

Your premium will be credited to the Account Value after deduction of any applicable charges and you will enjoy a relatively higher rate of return than most bank deposits. In addition, when a policy has been in force for 15 years or more, the total interest and Extra Bonus credited to the policy will be such that the Account Value is guaranteed to have accumulated to at least an amount as if the interest rate credited had been 3% p.a., regardless of the economic situation.

3 Financial Flexibilities

To achieve your financial goals faster with higher returns, you can make:

|

Flexible Increase of Premium |

|

| When your policy has accumulated a Cash Value sufficient to cover the monthly charges, you can enjoy the following flexibilities without the need to reduce the Basic Sum Insured: |

|

|

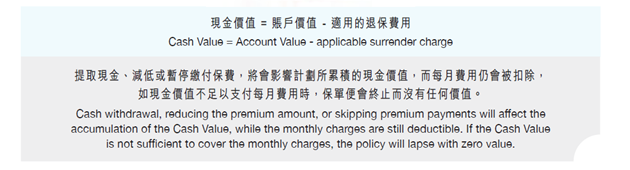

Greater Liquidity |

|

You can exercise the automatic periodic withdrawal option4 to withdraw a specified amount of Cash Value monthly/annually at preset time intervals, so that you can easily map out your fnancial needs, e.g. children's university education funds and retirement expenses. In addition, you can withdraw a portion of the Cash Value5 at any time to cope with emergencies. |

|

|

|

Skip Premium Payments |

3 Extra Protections for Total Peace of Mind

Unemployment Protection

Should the policyowner be made redundant, there is an option which allows suspension of premium payments for 365 days. During this entire "Special Grace Period", you will remain fully covered by the insurance6.

Terminal Illness Protection

In the event of the insured being first diagnosed with Terminal Illness7, a sum of Terminal Illness Benefit will be paid, which is the Death Benefit of the basic plan and supplementary benefit(s) (if any), to help relieve the financial burden.

Supplementary Rider Benefits

The plan also offers you a full spectrum of supplementary benefits at an additional premium:

Waiver of Premium Benefit – If the Insured suffers from total disability for a continuous period of not less than 6 months resulting from disease or bodily injury before the age of 65, the premiums required during the period of disability will be payable by the benefit.

Other supplementary benefits – Critical Illness Benefit, Comprehensive Cancer Benefit, Accident Benefit, etc.

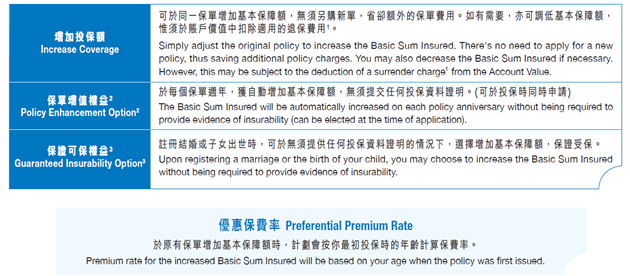

1 Decrease in the Basic Sum Insured will be implemented on a last-in-first-out basis, where the most recently commenced layer of Basic Sum Insured will be deducted first and the applicable surrender charge will be calculated accordingly.

2 Policy Enhancement Option will terminate on the policy anniversary following the Insured's 51st birthday. Please refer to the policy document for other terms and conditions.

3 The Guaranteed Insurability Option can be exercised one year after the Effective Date of Coverage, and will terminate on the policy anniversary following the Insured's 51st birthday. This option is also applicable to legal adoption of a child under the age of 18. For each time the Guaranteed Insurability Option is exercised, the increase in Basic Sum Insured shall not exceed 25% of the Basic Sum Insured before exercising the option, the aggregate increase in Basic Sum Insured of all FLEXI-ULife Prime Saver policies under the Insured by this option shall not exceed US$50,000/HK$/MOP400,000, and this option can at most be exercised twice. Please refer to the policy document for the relevant terms and conditions.

4 Automatic periodic withdrawal option is only applicable if the policy has been in force for at least 10 years, the withdrawal charge will be waived. Current requirement on minimum monthly withdrawal amount is US$500/HK$/MOP4,000, with minimum withdrawal period of one year; and the minimum annual withdrawal amount is US$6,000/HK$/MOP48,000, with minimum withdrawal period of three years. For any change after the application has been confirmed, a nominal fee will be levied.

5 The current charge for each withdrawal is US$25 or HK$/MOP200.

6 Unemployment Protection is only applicable to the Basic Plan.

7 Terminal Illness means a disease of the Insured, which in the opinion of our appointed medical consultant is likely to lead to death of the Insured within twelve months. Upon payment of the Terminal Illness Benefit, the related policies and all the supplementary benefit(s) attached will automatically be terminated. Please refer to the policy document for the relevant terms and conditions.

The above contains general information, is for reference only and does not form part of the policy. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555.