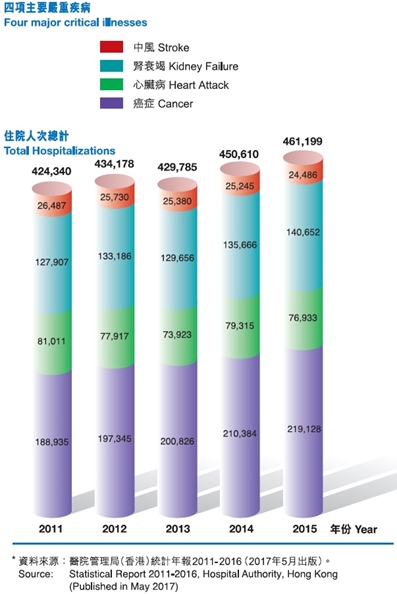

Over the past five years, the number of hospitalizations due to critical illnesses, such as cancer, heart attack, kidney failure and stroke, reached over 2.2 million. Over 46%* of the hospitalizations were due to the number-one killer disease– cancer. In addition, critical illnesses are now striking patients at a younger age. With advanced medical science and prompt quality treatment, the chances of recovery from a critical illness are very high. However, with soaring medical treatment and pharmaceutical costs, how could you effectively transfer the financial risk to avoid becoming a burden on your family if you were stricken by a critical illness?

MassMutual Asia proudly presents you its Critical Illness Supreme Benefit, offering comprehensive coverage of up to 56 critical illnesses and 8 Carcinoma-in-situ/ Early Stage Cancers as well as 8 Severe Child Diseases, to free you and your family from worry.

Coverage of 56 Critical Illnesses

Critical Illness Supreme Benefit covers up to 56 critical illnesses (Table 1). Upon diagnosis of any one of the critical illnesses covered, you will receive an immediate lump-sum advance payment, from the Sum Insured of the life insurance plan1, which can be used at your discretion to help relieve any financial burden.

Coverage of 8 Carcinoma-in-situ / Early Stage Cancers

This supplementary benefit also covers eight types of Carcinoma in-situ / Early Stage Cancers (Table 2), providing a lump-sum benefit payment equivalent to 30% of the Sum Insured in advance1 from the life insurance plan upon diagnosis2, up to a maximum of US$30,000 /HK$ / MOP240,000, allowing you to secure prompt quality treatment without worry and to help relieve the huge financial burden during recovery.

Coverage of 8 Severe Child Diseases

To care for and offer a comprehensive safeguard for children, this supplementary benefit covers eight Severe Child Diseases (Table 3),providing a lump-sum benefit payment equivalent to 30% of the Sum Insured in advance1 upon diagnosis 3, up to a maximum ofUS$30,000 / HK$ / MOP240,000.

Extension of Life Protection

To ensure that you are well protected at all times, you may opt for taking out a permanent life insurance plan4. This option is valid within 90 days following the end of one year after the diagnosis of a Critical Illness with the total benefit claims reaching 100% of the Sum Insured under this supplementary benefit, without the need to provide proof of insurability. The maximum Sum Insured can be up to 100% of the total benefit made under this supplementary benefit.

MediNet Pro

Second Medical Opinion Provided by US Medical Specialists5 — If the Insured has been diagnosed with one of the critical illnesses covered, our unique MediNet Pro scheme allows alternative medical advice to be sought, on the illness and methods of treatment available, from renowned medical specialists at leading hospitals in the USA. Quality Treatment Referrals in the USA5 — In addition, MediNet Pro can refer the Insured, if diagnosed with one of the critical illnesses covered, to a hospital network in the USA to receive quality treatment at a discounted price. Currently, more than 4,000 US hospitals are members of the MediNet Pro network.

Click to enlarge image

1. Upon payment of benefit, the Sum Insured of the basic plan/term life supplementary benefit to which this supplementary benefit is attached will be reduced accordingly. The maximum amount of the sum of “Critical Illnesses”, “Carcinoma-in-situ/Early Stage Cancer” and “Severe Child Disease” benefit payable is equal to 100% of the Sum Insured. This supplementary benefit shall terminate upon payment of the maximum claim amount.

2. Within the benefit term, “Carcinoma-in-situ/Early Stage Cancer” can be claimed once only. Benefit payment for “Carcinoma-in-situ/Early Stage Cancer” is 30% of the Sum Insured, subject to a maximum aggregate benefit of US$30,000/HK$/MOP240,000 under all benefits issued by the Company under the same Insured.

3. Only applicable when the Insured is first diagnosed with a “Severe Child Disease” before the policy anniversary on or following the Insured’s 25th birthday. Within the benefit term, the “Severe Child Disease” benefit can be claimed once only. Benefit payment for “Severe Child Disease” is 30% of the Sum Insured, subject to a maximum aggregate benefit ofUS$30,000/ HK$/MOP240,000 under all benefits issued by the Company under the same Insured.

4. Only applicable to the Insured aged below 76. Please refer to the policy document for the terms and conditions of the insurance application.

5. MediNet Pro is provided by Inter Partner Assistance Hong Kong Ltd. The current administration fee for each Second Medical Opinion is HK$500. For each referral to medical treatment in the USA, the current administration fee is US$500. The Insured is also responsible for paying the administration fee and for any medical treatment and other related costs in the USA. Inter Partner Assistance Hong Kong Ltd. reserves the right to review the price and the number of hospitals from time to time without prior notice.

6. Benefit payment for“ Cerebral Aneurysm Requiring Surgery” is 50% of the Sum Insured. Within the benefit term, this benefit can be claimed once only.

7. Within the benefit term “, Angioplasty” can be claimed once only. Benefit payment for “Angioplasty” is 10% of the Sum Insured, subject to a maximum aggregate benefit of US$12,500 / HK$ / MOP100,000 under all benefits issued by the Company under the same insured.

8. Only applicable to the Insured aged 18 to 65 .

9. Within the benefit term“, Accidental Reconstructive Surgery” can be claimed once only. Benefit payment for Accidental Reconstructive Surgery” is 30% of the Sum Insured or the actual amount of hospitalization and surgical expenses not reimbursed by other medical plans (whichever is the lower), subject to a maximum aggregate benefit of US$30,000 / HK$ / MOP240,000 under all benefits issued by the Company under the same Insured.

Remarks: For the definition of each“ Critical Illness”“, Carcinoma-in-situ / Early Stage Cancer” and“ Severe Child Disease”, please refer to the policy document.

The above content contains general information and is for reference only. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555.