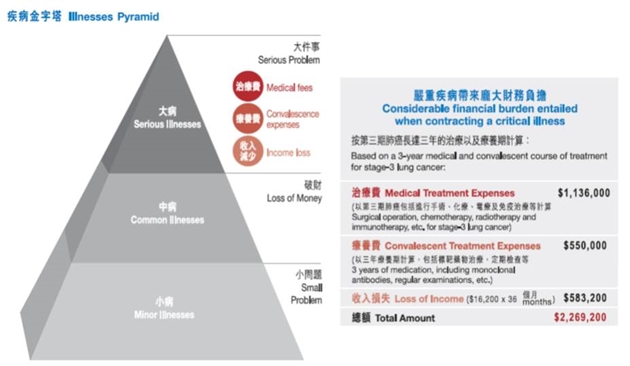

What is your "prime" choice? Wealth, status, love or family ?... In fact, good health is what enables us to pursue our life goals and enjoy life the most. However, life is unpredictable.

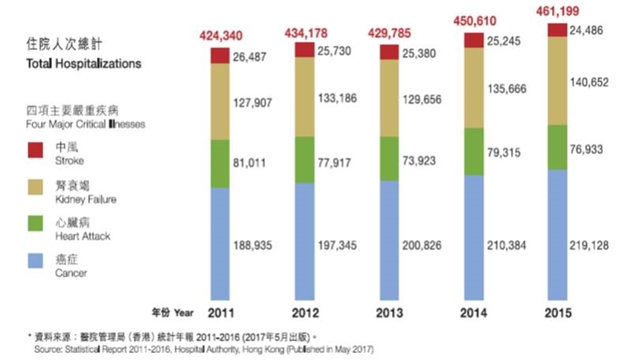

The number of hospitalizations due to critical illnesses has shown a steadily increasing trend, and critical illnesses are now striking patients at a younger age.

Knowing that good health is your prime concern, MassMutual Asia is proud to offer you its PrimeHealth Saver 100+. The plan is truly the prime choice to safeguard your health, it offers not only critical illness protection, but also savings and life protection. Coverage of 116 Illnesses

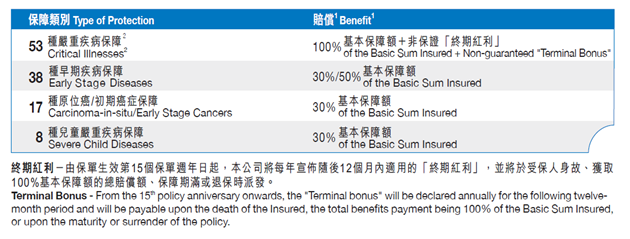

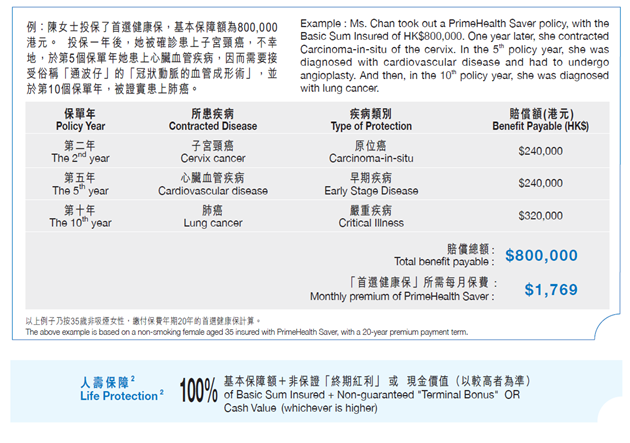

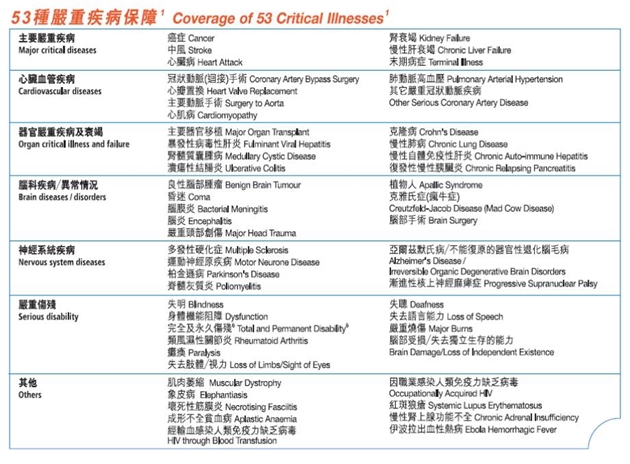

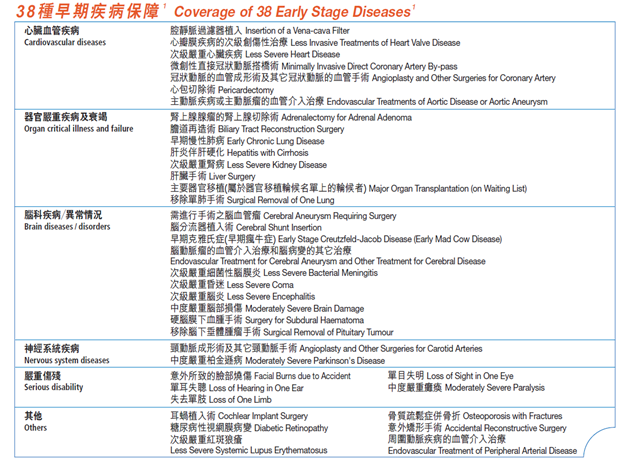

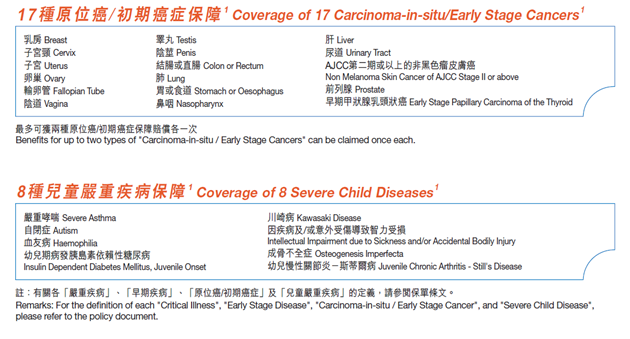

PrimeHealth Saver covers up to 53 Critical Illnesses, 38 Early Stage Diseases, and 17 types of Carcinoma-in-situ/Early Stage Cancer, as well as 8 Severe Child Diseases. The comprehensive protection provided allows you to receive timely and quality treatment even in the early stages after diagnosis. It also helps to ease your financial burden due to loss of income during the period of convalescence, giving you extra peace of mind.

Whole Life Protection up to Age 100

You can enjoy absolute peace of mind, knowing that the benefit term of the plan lasts up to age 100. You may also select from three premium-payment-term options: 10 Years, 15 Years and 20 Years. Best of all, beyond the premium payment term, you will continue to enjoy full protection without paying any further premiums.

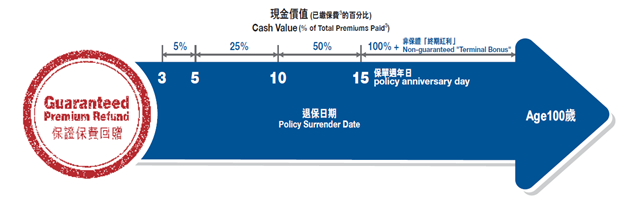

Guaranteed Refund of Premium 100+

Effective from the 15th policy anniversary onwards, if you surrender the policy, the plan offers you a guaranteed "Refund of Premium"3 without deduction of any claims paid. In addition, a non-guaranteed "Terminal Bonus" will be offered at the same time so that you can enjoy a higher potential return. What's more, starting from the 3rd policy anniversary onwards, the plan offers you partial "Refund of Premium" upon policy surrender.

Extension of Life Protection

We understand that you may like to give extra protection to your family, if diagnosed with a critical illness. Therefore, you may opt to take out a permanent life insurance plan4 within 90 days following the end of one year after the diagnosis of a critical Illness with the total benefit claims reaching 100% of the Basic Sum Insured, without the need to provide any satisfactory proof of insurability. The Sum Insured may be up to 100% of the Basic Sum Insured under the original plan.

MediNet Pro

Currently, more than 4,000 US hospitals are members of the MediNet Pro network. If the Insured has been diagnosed with any of the covered illnesses, the following services are available: 1) second medical opinion provided by US medical specialists5 , and 2) quality treatment referrals in the USA5 - the Insured can receive quality treatment at a discounted price.

1. The maximum amount of the sum of Critical Illnesses, Early Stage Diseases, Carcinoma-insitu/Early Stage Cancers and Severe Child Diseases benefit payable is equal to "the sum of100% of the Basic Sum Insured and non-guaranteed Terminal Bonus" or Cash Value, whichever is higher. Unless otherwise specified, each covered illness can be claimed once within the benefit term. Angioplasty and Other Surgeries for Coronary Artery can be claimed up to two times. Up to two types of "Carcinoma-in-situ / Early Stage Cancers" benefit can be claimed once each. Severe Child Diseases benefit can be claimed once only. The policy shall terminate upon payment of the total benefits has reached 100% of the Basic Sum Insured.

2. Only applicable to the Insured aged below 76.

3. If the policy has accumulated a higher Cash Value, the benefit payable will be based on the Cash Value. The benefit amount will deduct any claim benefits paid.

4. The calculation of Total Premiums paid is based on the "Annual Premium of Basic Plan".

5. MediNet Pro is provided by Inter Partner Assistance Hong Kong Ltd. The current administration fee for each Second Medical Opinion is HK$500. For each referral to medical treatment in the USA, the current administration fee is US$500. The Insured is also responsible for paying the administration fee and for any medical treatment and other related costs in the USA. Inter Partner Assistance Hong Kong Ltd. reserves the right to review the price and the number of hospitals from time to time without prior notice.

6. The coverage for "Total and Permanent Disability" is only applicable to Insured aged 18 to 65.

7. Once insured, the premiums will not increase as the age of the Insured increases. However, the Company reserves the right to adjust the premium rate for all Insured of the same risk class.

8. The maximum aggregate Sum Insured of all PrimeHealth Diabetes Care, Supplementary Cancer Benefit, PrimeHealth Saver 1000, PrimeHealth Extra Saver, PrimeHealth Benefit, PrimeHealth Extra Care, PrimeHealth Saver 100+, Critical Illness Supreme 100+ Premium Refundable Plan, Critical Illness Supreme Benefit, Critical Illness Plus 100% Premium Refundable Plan, Critical Illness Benefit, Critical Illness Extra Benefit, Critical Illness Double Benefit, Comprehensive Cancer Benefit, Total and Permanent Disability Benefit and Update Jr. Health Benefit under the same Insured with the Company is US$1,500,000/HK$/MOP12,000,000.

The above content contains general information and is for reference only. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555.