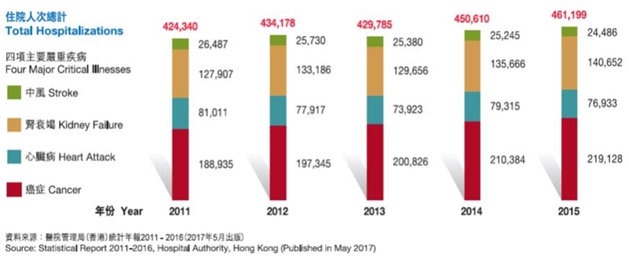

The number of hospitalizations due to critical illnesses has shown a steadily increasing trend, and critical illnesses are now striking many people at a much younger age.

|

Among the four major critical illnesses, the proportion of hospitalizations due to cancer now exceeds 45%. The risk of cancer should not be underestimated. |

|

Almost 40%† of people newly diagnosed with cancer are aged in their 20s to 50s and in the middle of their careers. |

|

Cancer is no doubt the biggest threat to our health, but thanks to the advances in medical science, the cure rate has been significantly improving. Taking colorectal cancer as an example, the 5-year survival rate for Stages I and II colorectal cancer is over 90%^ while the rate for Stage III colorectal cancer can be as high as 70%^. |

|

However, cancers may relapse even after treatment. For example, the chance of a recurrence of liver cancer one year after treatment is as high as 30% - 40% on average#. The key to a successful cure therefore is to have adequate financial support for prompt and quality treatment. |

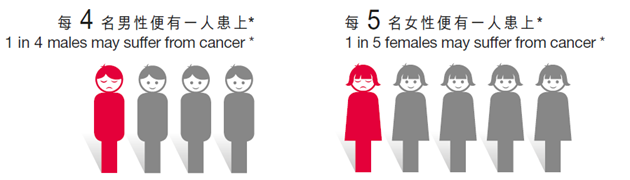

* Percentage of Hong Kong people developing cancer before the age of 75, according to 2015 Hong Kong Cancer Statistics, Hong Kong Cancer Registry, Hospital Authority (published in November 2017).

† The average percentage of cancer patients aged from 20 to 59 among all age groups, according to 2010-2015 Hong Kong Cancer Statistics, Hong Kong Cancer Registry, Hospital Authority (published in November 2017).

^ Figure(s) collected from the website of CUHK Jockey Club Bowel Cancer Education Centre (downloaded in December 2016).

# Figure(s) collected from the website of the Latest Cancer News of the Hong Kong Cancer Fund (downloaded in December 2016).

MassMutual Asia’s PrimeHealth Extra Care is an insurance solution that bundles critical illness and life protection, as well as savings into a single policy. Best of all, the plan allows multiple claims for common illnesses, such as Cancers. This is no doubt the prime choice for safeguarding not only your health, but also your wealth.

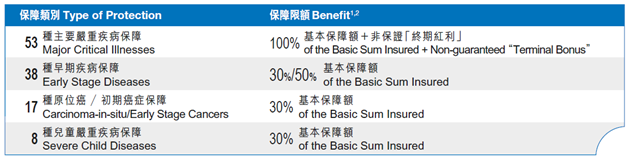

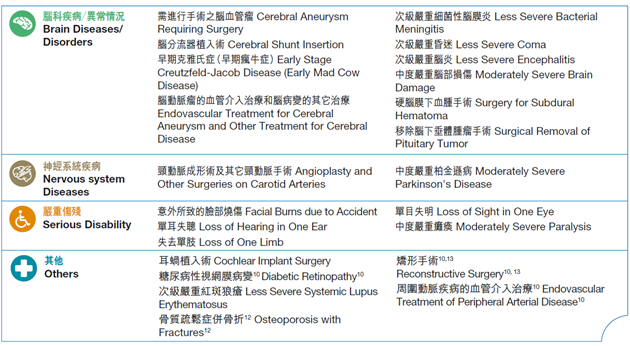

Coverage of 116 Illnesses

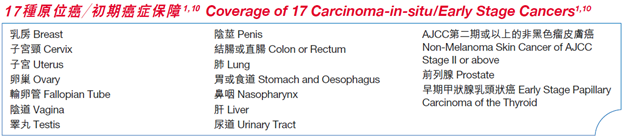

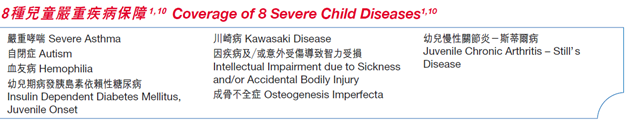

PrimeHealth Extra Care provides comprehensive protection and covers up to 53 Major Critical Illnesses, 38 Early Stage Diseases, and 17 types of Carcinoma-in-situ/Early Stage Cancers, as well as 8 Severe Child Diseases.

Terminal Bonus — From the 18th policy anniversary onwards, the “Terminal Bonus” will be declared annually for the following twelve-month period and will be payable upon the maturity or surrender of the policy, or upon the death of the Insured or the total benefit payments being 100% of the Basic Sum Insured.

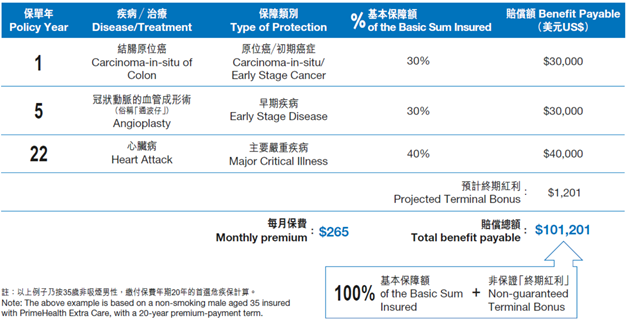

| Example: Mr. Chan, aged 35, took out a PrimeHealth Extra Care policy, with a Basic Sum Insured of US$100,000. |

|

Life Protection

PrimeHealth Extra Care also provides life protection3. In the unfortunate event of the death of the Insured, the life protection benefit will be paid to the designated beneficiary.

Whole Life Protection up to Age 100

You can enjoy absolute peace of mind, knowing that the benefit term of the plan lasts up to age 100. You may also select from three premium-payment term options: 10 Years, 15 Years and 20 Years to suit your needs. Best of all, beyond the premium-payment term, you will continue to enjoy full protection without paying any further premiums.

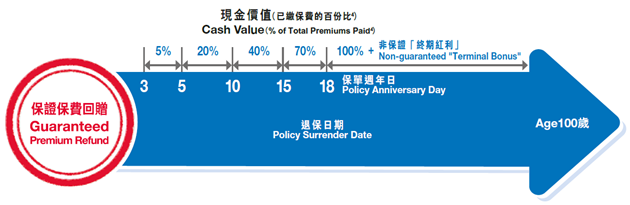

Guaranteed Refund of Premiums

Effective from the 18th policy anniversary onwards, if you surrender the policy, the plan offers you a guaranteed “100% Refund of Premiums”4 without deduction of any claims paid, provided that the total benefit payments under the plan are less than 100% of the Basic Sum Insured. In addition, a non-guaranteed “Terminal Bonus” will be offered at the same time so that you can enjoy a higher potential return. What’s more, starting from the 3rd policy anniversary onwards, the plan offers you partial “Refund of Premiums” upon policy surrender.

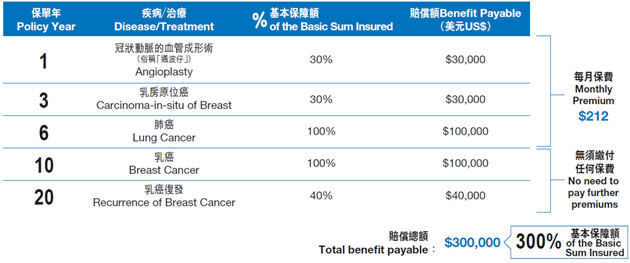

Multiple Cancer Benefit

As a result of medical advancements, the cure rate for Cancer has been increasing. However, Cancer remains a threat to patients as the rate of recurrence is much higher than that of other critical illnesses, not to mention the prolonged treatment process. In view of this, the plan provides the Insured with Multiple Cancer Benfit5 which will be activated if the first Major Critical Illness claim is for Cancer:

■ Even if the total benefit payments have reached 100% of the Basic Sum Insured, the policy remains effective so that the Insured will be entitled to two additional claim payments for Cancer up to age 75 without paying any further premiums;

■ Benefit will also be paid no matter whether the Cancer is a recurrence or metastasis of the preceding Cancer, or is an existing or a new cancer, provided that the period elapsed between the diagnosis dates of the respective Cancers is three years or more;

■ The total benefits payable under the policy can be up to 300% of the Basic Sum Insured6.

| Example: Miss Lee, aged 30, took out a PrimeHealth Extra Care policy, with a Basic Sum Insured of US$100,000. |

|

Note: The above example is based on a non-smoking female aged 30 insured with PrimeHealth Extra Care, with a 20-year premium-payment term.

Extension of Life Protection

We understand that in the unfortunate event of being diagnosed with a critical illness, one may like to give extra protection to the family. Therefore, without the need to provide any satisfactory proof of insurability, the Insured may opt to take out a permanent life insurance plan7 within 90 days following the end of one year after the diagnosis of a Critical Illness with the total benefit claims reaching 100% of the Basic Sum Insured. The sum insured maybe up to 100% of the Basic Sum Insured under the plan.

MediNet Pro

Currently, more than 4,000 US hospitals are members of the MediNet Pro network. If the Insured has been diagnosed with any of the covered illnesses, the following services are available:1) second medical opinion provided by US medical specialists8, and 2) quality treatment referrals in the USA8 - the Insured can receive quality treatment at a discounted price.

Unlimited claims, but subject to one claim per illness (unless otherwise specified).

Carcinoma-in-situ/Early Stage Cancers can be claimed for twice but only once for each type.

Can be claimed for once only.

Remark: For the definition of each "Major Critical Illness","Early Stage Disease", “Carcinoma-in-situ / Early Stage Cancer", and "Severe Child Disease", please refer to the policy document.

Notes

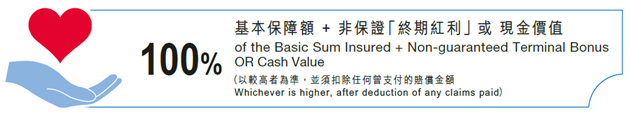

1. The maximum amount of the sum of benefits payable for Major Critical Illnesses, Early Stage Diseases, Carcinoma-in-situ/Early Stage Cancers and Severe Child Diseases is equal to “the sum of 100% of the Basic Sum Insured and non-guaranteed Terminal Bonus” or Cash Value, whichever is higher.

2. If more than one Critical Illness diagnosed on the same day are arising from the same illness or injury, the claim will be paid once only for the Critical Illness with the higher benefit amount.

3. Only applicable to the policy if total benefits paid have not reached 100% of the Basic Sum Insured.

4. The calculation of Total Premiums paid is based on the “Annual Premium of Basic Plan” (excluding extra loading premiums).

5. The Multiple Cancer Benefit provides two additional claim payments for Cancers totaling up to 200% of the Basic Sum Insured. The first claim under the Multiple Cancer Benefit is 100% of the Basic Sum Insured, while the second claim is 100%of the Basic Sum Insured net of any previous Critical Illness Benefit paid (except Major Critical Illness). This Benefit is only applicable to the Insured surviving for at least 14 days from the date of diagnosis.6. If the first claim for Major Critical Illness is made on or after the 18th anniversary of the policy, the Terminal Bonus applicable at the time of the benefit payment will also be paid. That means together with the Multiple Cancer Benefit, the total benefits payable of the policy will be up to 300% of the Basic Sum Insured plus Non-guaranteed Terminal Bonus.

7. Only applicable to the Insured aged below 76.

8. MediNet Pro is provided by Inter Partner Assistance Hong Kong Ltd. The current administration fee for each Second Medical Opinion is HK$500. For each referral to medical treatment in the USA, the current administration fee is US$500. The Insured is also responsible for paying the administration fee and for any medical treatment and other related costs in the USA. Inter Partner Assistance Hong KongLtd. reserves the right to review the price and the number of hospitals from time to time without prior notice. The Company reserves the right to change or discontinue this service at any time.

9. Coverage for “Total and Permanent Disability” is only applicable to Insured aged18 to 65.

10. Subject to US$37,500 / HK$/MOP300,000 per type of illness per life limit under all benefits issued by the Company.

11. To be eligible for a claim, the coronary artery must have a stenosis of 50% or higher; to be eligible for a second claim, in addition to the above-mentioned criterion, the treatment must also be performed on a location of stenosis or obstruction in a major coronary artery where no stenosis greater than 60 percent was identified in the medical examination report relating to the first claim.

12. Subject to US$18,750 / HK$/MOP150,000 per type of illness per life limit under all benefits issued by the Company. The protection is up to age 70 of the Insured.

13. Benefit payment is the actual amount of hospitalization and medical expenses not yet reimbursed.

14. The maximum aggregate Sum Insured of all PrimeHealth Diabetes Care, Supplementary Cancer Benefit, PrimeHealth Saver 1000, PrimeHealth Extra Saver, PrimeHealth Benefit, PrimeHealth Extra Care, PrimeHealth Saver 100+, Critical Illness Supreme 100+ Premium Refundable Plan, Critical Illness Supreme Benefit, Critical Illness Plus 100% Premium Refundable Plan, Critical Illness Benefit, Critical Illness Extra Benefit, Critical Illness Double Benefit, Comprehensive Cancer Benefit, Total and Permanent Disability Benefit and Update Jr. Health Benefit under the same Insured with the Company is US$1,500,000/HK$/MOP12,000,000.

15. Once insured, the premiums will not increase as the age of the Insured increases. However, the Company reserves the right to adjust the premium rate for all Insured of the same risk class.

The above content contains general information and is for reference only. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555, Macau (853) 2832 2622.