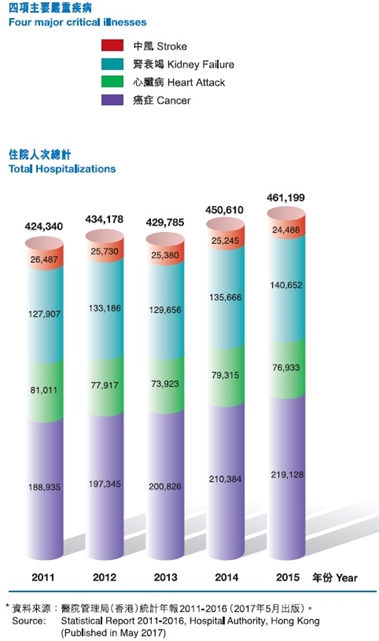

There has been an increasing number of hospital admissions in the past 5 years. Over 2.2 million of them were due to critical illnesses such as cancer, heart attack, stroke and kidney failure1. Have you ever wondered how you would cope with the financial burden if you were to suffer from similar misfortune?

MassMutual Asia offers you with three Critical Illness Benefit plans to choose from, all coming with comprehensive coverage of 56 illnesses to free you and your family from worries.

Option 1 - Critical Illness Benefit

Better coverage

For just a little more, Critical Illness Benefit2 guarantees you a lump sum advance payment from the life insurance plan at the first occurrence of a debilitating illness. This provides you with extra funds to get you the best possible medical treatment.

Option 2 - Critical Illness Extra Benefit

Extra benefit Extra protection

Critical Illness Extra Benefit2 offers a lump-sum benefit which is an EXTRA protection rather than an advance from your life insurance policy, therefore giving you and your loved ones total peace of mind.

Option 3 - Critical Illness Double Benefit

Immediate payment of benefit

Critical Illness Double Benefit3 goes further to offer you the best possible protection against the unpredictable. The lump-sum benefit, which is not an advance from your life insurance policy, is payable immediately upon diagnosis of critical illness.

Extra monthly benefit for extra peace of mind

During the rehabilitation period, you will receive an Extra Monthly Benefit equivalent to 5% of the Sum Insured from the first month of diagnosis4, up to a maximum of 30 months. This extra money will help cover your financial outgoings, be they your mortgage repayments, daily expenses or your children’s education.

Extra life coverage

Critical Illness Double Benefit provides Extra Life Coverage. This amount, equivalent to the Sum Insured less any critical illness lump sum benefit paid, is payable in the event that the worst happens for whatever reason.

1. Source: Statistical Report 2011-2016, Hospital Authority, Hong Kong (Published in May 2017).

2. The maximum benefit amount that can be claimed under this plan is 100% of the Sum Insured.

3. The maximum lump-sum benefit amount that can be claimed under this plan is 100%of the Sum Insured.

4. Extra Monthly Benefit for “Cerebral Aneurysm Requiring Surgery” is 2.5% of the Sum Insured. Extra Monthly Benefit is not applicable to “Angioplasty” and “Accidental Reconstructive Surgery”.

5. Benefit payment for “Cerebral Aneurysm Requiring Surgery” is 50% of the Sum Insured. Within the benefit term, this benefit can be claimed once only.

6. Within the benefit term, “Angioplasty” can be claimed once only. Benefit payment for “Angioplasty” is 10% of the Sum Insured, subject to a maximum aggregate benefit ofUS$12,500 / HK$100,000 under all benefits issued by the Company under the same insured.

7. Only applicable to the insured aged 18 to 65.

8. Within the benefit term, “Accidental Reconstructive Surgery” can be claimed once only. Benefit payment for “Accidental Reconstructive Surgery” is 30% of the Sum Insured or the actual amount of hospitalization and surgical expenses not reimbursed by other medical plans (whichever is the lower), subject to a maximum aggregate benefit of US$30,000 / HK$240,000 under all benefits issued by the Company under the same insured.

The above contains general information and is for reference only. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong: (852)2533 5555.