The ageing population is causing an increase in medical expenses. The statistics also show that the annual number of hospitalizations is 2,006,993. If you were hospitalized, how would you cope with the financial burden of medical and convalescent treatment?

MassMutual Asia is thus proud to present Whole Life MediCare. Not only does it guarantee a fixed premium rate, but by paying the premium for 25 years only, your coverage of up to $2 million will be lifelong, giving you total peace of mind.

Comprehensive Health Benefits of Up to $2 Million

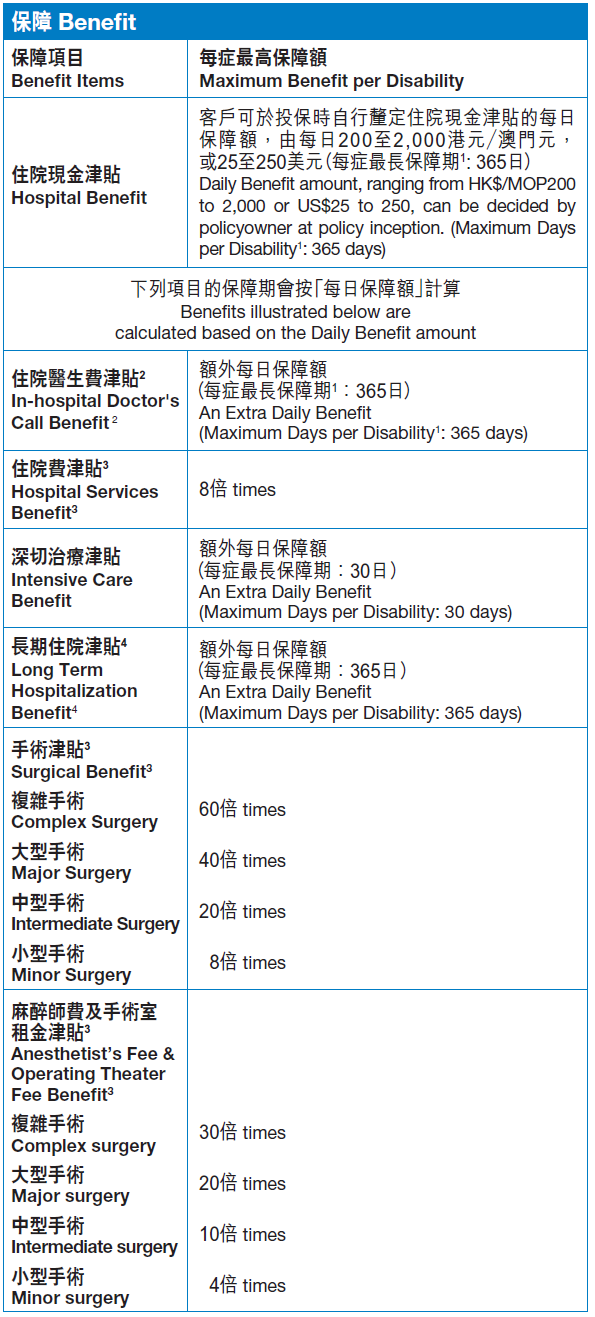

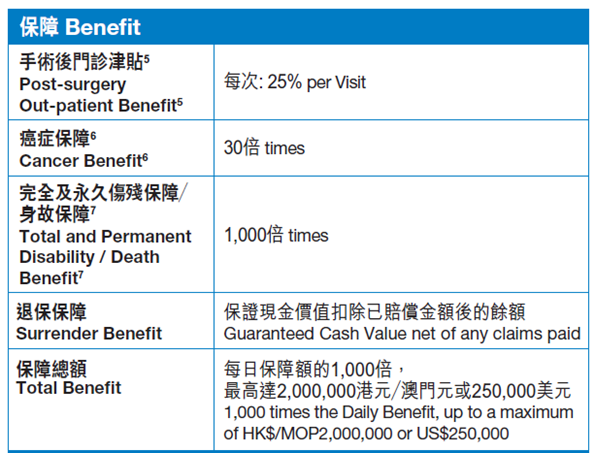

Carrying a full range of benefits, Whole Life MediCare provides you with benefits of up to a maximum of HK$/MOP2,000,000 or US$250,000. Not only does it cover such basic in-hospital expenses as Hospital Benefit, In-hospital Doctor's Call Benefit and Hospital Services Benefit, it also provides all-round surgical protection covering Surgical Benefit, Anesthetist's Fee and Operating Theater Fee Benefit. Best of all, this plan offers a unique Death Benefit and Surrender Benefit, giving you and your family both protection and savings in one single plan.

Whole Life Coverage for Lifelong Peace of Mind

With Whole Life MediCare, you are assured of full health protection for a benefit term of up to age 100, so that you can live your life to the full.

Guaranteed Premium with 25-year Premium Payment Term Only

To give you a guaranteed premium rate with no hidden surprises, the planned premium is locked in once the policy is issued. With this guaranteed rate, your premium is fixed and your protection is guaranteed for life but with a 25-year premium payment term.

Top-notch Worldwide Coverage

This plan provides protection for hospital confinement due to accident or sickness anywhere in the world*, giving you even more peace of mind.

* If the Insured requires in-patient treatment exceeding 24 hours due to accident or sickness in Hong Kong, Macau, Japan, Singapore, Malaysia, Taiwan, South Korea, Northern America, Europe, Australia or New Zealand, this plan will provide full coverage. If hospitalization takes place in countries other than the foregoing, the Insured will also enjoy up to 50% of maximum benefit for a period of up to 90 days, and no Long Term Hospitalization Benefit will be paid.

1 Maximum period of payment for mental disorder is 90 days on a per life basis.

2 The In-hospital Doctor's Call Benefit, which is payable for a maximum of one in-hospital doctor's visit per day, is equal to the daily benefit or the actual expenses incurred for the respective doctor's visit net of other claims received, whichever is lower.

3 The actual Hospital Services Benefit, Surgical Benefit, Anesthetist's Fee and Operating Theater Fee Benefit payable are based on the actual expenses incurred, net of other claims received, subject to the maximum benefit per disability.

4 Long Term Hospitalization Benefit is payable on the 91st day and onwards of hospitalization until the end of the Hospital Benefit payable per disability. Long Term Hospitalization Benefit is not applicable to mental disorders or hospitalization occurring outside Hong Kong, Macau, Japan, Singapore, Malaysia, Taiwan, South Korea, Northern America, Europe, Australia or New Zealand.

5 This benefit is payable on one occasion per day within 14 days after discharge from the hospital and only where the out-patient treatment provided by the doctor-in-charge is directly related to and is a result of the Surgical Procedure.

6 The Cancer Benefit is payable on one occasion on a per-policy basis.

7 Total and Permanent Disability Benefit is payable when the insured suffers from total and permanent disability aged between 4 and 65. Maximum Total Benefit is up to 1,000 times the Daily Benefit. If a claim is paid, the amount of Total and Permanent Disability Benefit/Death Benefit will be equal to the Maximum Benefit net of any claims paid. The Death Benefit is guaranteed to be at least 10 times the Daily Benefit.

8 The maximum aggregate daily benefit from Hospital Income, Money-Back Hospital Income Protector, Lifetime Health Protector, Whole Life Medicare and Refundable Hospital Cash Plan under the same Insured with the Company is US$250/HK$/MOP2,000. The Company reserves the right to make adjustments of the maximum combined daily benefit without any prior notice.

This brochure is for reference only. Please refer to policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline in Hong Kong on (852)2533 5555.