What is the likelihood of your being admitted to hospital?

High Possibility of Hospitalization: According to Hospital Authority statistics+, over recent years, annual hospitalizations due to accidents and diseases in Hong Kong have averaged over 2 million, with almost one in four people needing in-patient treatment each year.

Long Queues for Public Medical Services: Over-stretched public medical services inevitably result in long queues for medical treatment. Worst of all, the types of treatment and medicines available are limited.

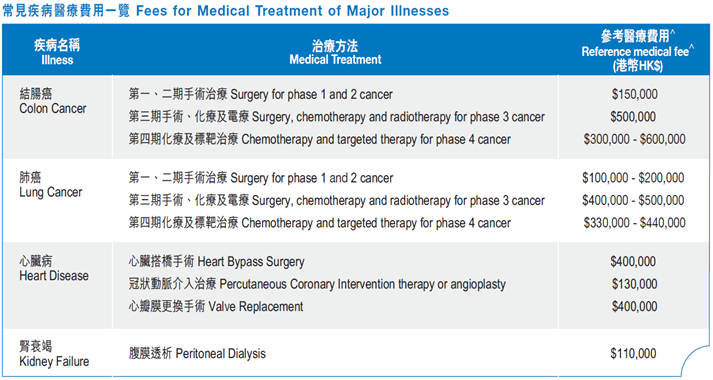

Expensive Private Medical Treatment: Immediate and quality medical treatment is available in private hospitals. However, such treatment is usually much more expensive. For example, the hospital expenses for the most common cancer in Hong Kong, colorectal cancer, involve costs easily mounting to between HK$100,000 and HK$200,000^.

The best way to care for yourself and show your love for your family is to have comprehensive medical insurance in place - because nothing is more valuable than good health.

+ Source: Statistical Report 2012 – 2017, Hospital Authority, Hong Kong (Published in Feb 2018)

^ Source: The above medical expenses are provided by registered medical practitioner and private hospitals, and are for reference only. Actual fees depend upon patient's actual medical condition, medication, case complexity, doctor's fees, and choice of hospital, etc.

MassMutual Asia is proud to offer you its comprehensive Hospital & Surgical Plus. To give you extra peace of mind, three supplementary benefits are available, including Extra Major Medical Benefit, Extra Cancer Benefit and Hospital Income Benefit.

Hospital & Surgical Plus

Extensive Coverage

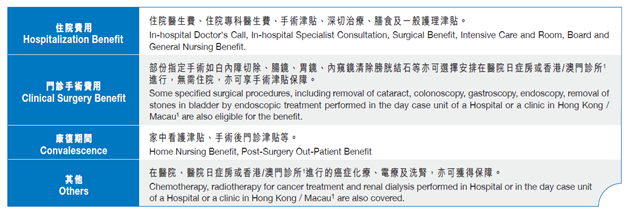

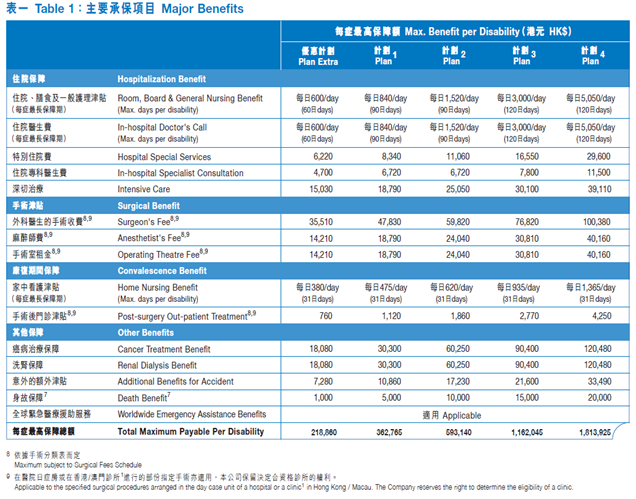

The plan provides you with comprehensive coverage and reimburses the actual hospitalization and medical expenses incurred due to sickness or accident. It gives you total peace of mind knowing that you can always get immediate treatment at private hospitals without suffering any devastating financial set-backs. There are 5 plan levels to choose from, with a maximum reimbursement of medical expenses of up to HK$1.81 million for each illness or accident.

Lifetime Coverage Till Age 100

To ensure you are well covered at all times, this yearly renewal plan offers a benefit term up to age 100, enabling you to easily cope with unexpected medical expenses. Moreover, the coverage may be reviewed upon renewals2 in order to ensure adequate protection for you and to combat soaring medical costs. Renewal premium will be adjusted based on the attained age of the insured and at the premium rate in effect of the same level of benefit at the time of renewal.

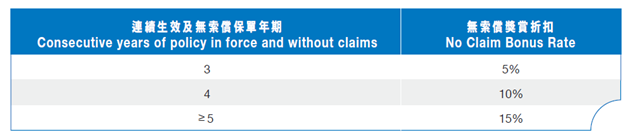

No Claim Bonus

Provided that the policy has been in force for three consecutive policy years and no claims were made under the Hospital & Surgical Plus and Extra Major Medical Benefit, you will be entitled to a No Claim Bonus discount for both benefits upon paying the renewal policy premium. The discount is based on a percentage of the annual premium of the preceding year up to a maximum of 15%.

Worldwide Emergency Support

Wherever in the world you happen to be, the plan is available around the clock. At the same time, it offers free "Worldwide Emergency Assistance Benefits" in the event of an emergency. Instant assistance, including deposit guarantees for hospital admission and emergency evacuation, will be available through Inter Partner Assistance Hong Kong Ltd.

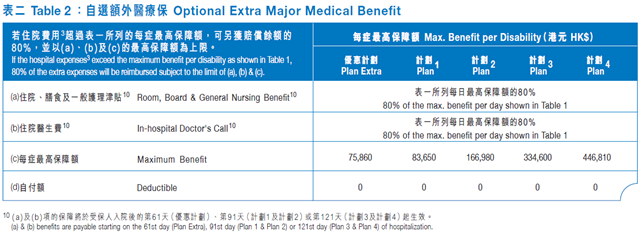

Extra Major Medical Benefit

For extra peace of mind, you may also opt for the Extra Major Medical Benefit. If the actual hospital expenses3 incurred are in excess of those covered by Hospital & Surgical Plus, this supplementary benefit will pay for a maximum reimbursement of over HK$440,000.

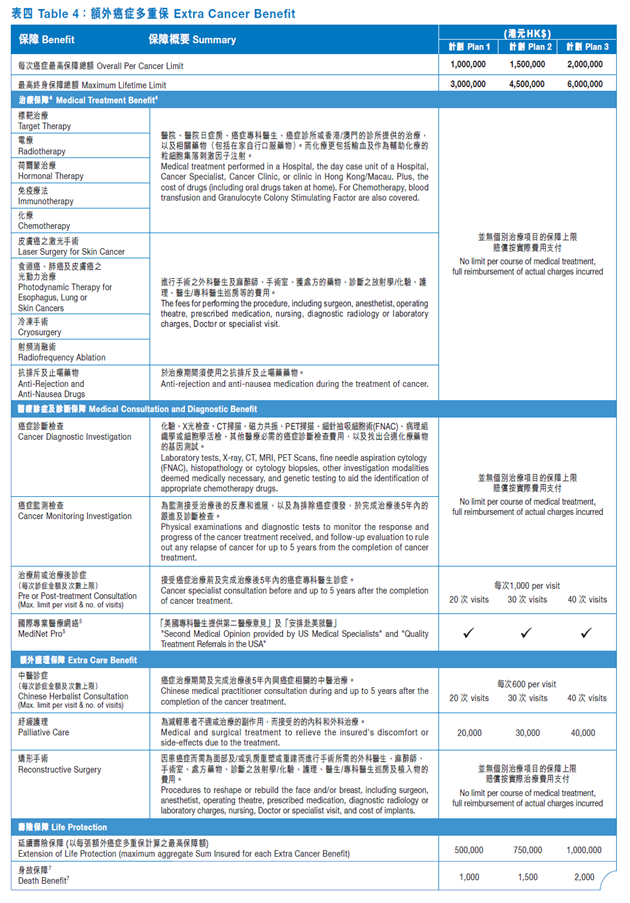

Extra Cancer Benefit

Provides adequate financial support for cancer therapy, with a maximum reimbursement of actual expenses per cancer up to HK$2,000,0004.

Benefit

1

Medical Treatment Benefit

Comprehensive cancer treatment benefit includes the costly target therapy, chemotherapy, radiotherapy, hormonal therapy, immunotherapy, laser surgery for skin cancer, photodynamic therapy for esophagus, lung or skin cancers, cryosurgery and radiofrequency ablation. In addition, the plan also covers charges for anti-rejection and anti-nausea drugs

Benefit

2 Extra Care Benefit

To relieve the insured's discomfort and the side-effects due to cancer treatment, the plan offers Chinese herbalist consultation and palliative care, as well as reconstructive surgery of the face and/or breast due to cancer.

Benefit 3 Medical Consultation and Diagnostic Benefit

To help the insured to receive timely and quality treatment in the early stages, the plan covers cancer diagnostic tests and medical consultations, as well as cancer monitoring investigation and medical consultations within 5 years after completion of treatment of cancer.

In addition, the following services are available at more than 4,000 US hospitals within the MediNet Pro network: 1) second medical opinion provided by US medical specialists5, and 2) quality treatment referrals in the USA5.

Benefit

4

Extension of Life Protection

We understand that, if diagnosed with a cancer, you may also wish to give extra protection to your family. We therefore offer you the option of taking out a permanent life insurance plan within 90 days following the

end of one year after the diagnosis of a later-stage cancer, without the need to provide any satisfactory proof of insurability, with the aggregate Sum Insured up to HK$1,000,000.

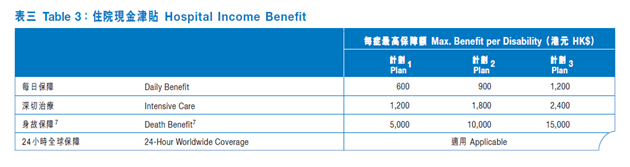

Hospital Income Benefit

Flexible Cash Benefit

The plan provides a daily cash benefit6 of up to HK$1,200 if the insured is hospitalized for eight hours or more due to sickness or injury, up to a maximum of 1,000 days, to offset any temporary income loss as well as day-to-day expenses. And, more importantly, you can spend the cash at your total discretion.

Double Cash Benefit

While receiving treatment in an Intensive Care Unit, the Hospital Income Benefit will be doubled, to up to HK$2,400 per day.

Death Benefit

In the unfortunate event that the insured passes away, a death benefit7 of up to HK$15,000 will be paid.

24-Hour Worldwide Coverage

Hospital Income Benefit is available all around the world, including North America, Europe, Australia, New Zealand, Japan, Singapore, Malaysia, Taiwan, South Korea, Hong Kong and Macau. For hospitalization in other areas, half of the daily benefit is available, for up to a maximum of 90 days.

|

|

1. The Company reserves the right to determine the eligibility of a clinic.

2. A written notice will be given no less than 30 days prior to each policy anniversary date regarding the adjustment of benefit coverage, p remium, or non-renewal of the policy.

3. Cancer Treatment Benefit, Renal Dialysis Benefit, Home Nursing Benefit and Post-surgery Out-patient

Treatment are not included.

4. The followings are not included: 1) treatment undergone solely for complications and adverse effects of cancer treatment; 2) cost of surgical procedures except specifically covered; 3) room and board charges.

5. MediNet Pro is provided by Inter Partner Assistance Hong Kong Ltd. The current administration fee for each Second Medical Opinion is HK$500. For each referral to medical treatment in the USA, the current administration fee is US$500. The Insured is also responsible for paying the administration fee and for any medical treatment and other related costs in the USA. InterPartner Assistance Hong Kong Ltd. reserves the right to review the price and the number of hospitals from time to time without prior notice.

6. The maximum combined daily benefit from both Hospital Income Benefit and Money-Back Hospital Income Protector for the same insured person with our company is HK$1,200. And the maximum combined daily benefit from Hospital Income Benefit, Money-Back Hospital Income Protector, Lifetime Health Protector, Whole Life MediCare and Refundable Hospital Cash Plan for the same insured person with our company is HK$2,000. The Company reserves the right to make adjustments of the maximum combined daily benefit withou t any prior notice.

7. Only applicable to the Insu red age of 18 or above.

Key Exclusions

For Hospital & Surgical Plus, Hospital & Surgical Benefit, Extra Major Medical Benefit, Supplementary Major Medical Benefit and Hospital Income Benefit

The policy will not pay any benefit claims caused by Sickness or Injury resulting directly or indirectly, by one or more of the following:

(1) Claims due to Sickness occurring within 15 days of Effective Date of Coverage;

(2) Pre-existing conditions (which presented signs or symptoms of which the Insured has been aware or should reasonably have been aware);

(3) General check-up, convalescence, custodial or sanatorium care or rest care;

(4) Cosmetic or plastic surgery; dental care or surgery (unless necessitated by injury caused by an accident);

refractive errors of the eyes; treatment for tonsils, adenoids or hernia (which occurred within 120 days after the Effective Date of Coverage); procurement or use of special equipment such as artificial limbs, eyes, hearing aids or dentures etc; treatment by Chinese bonesetter, acupuncturist or herbalist;

(5) Pregnancy, abortion, childbirth or miscarriage, and other complications arising therefrom; congenital deformities or anomalies;

(6) Suicide or injuries due to insanity; self-infliction; drug addiction or alcoholism;

(7) Racing on horse or wheels;

(8) Acts of war, riot or civil commotion, or participating in any illegal activity; waste nuclear weapons material, ionizing radiation or contamination by radioactivity from any nuclear fuel;

(9) Human Immunodeficiency Virus (including AIDS);

(10) The Insured is hospitalized for circumcision before attaining the age of 12, and such hospitalization occurs within two years of the Effective Date of Coverage (except Hospital Income Benefit);

(11) Expenses for which compensation is payable under any government law or any other insurance policy

For Extra Cancer Benefit

The exclusions of the above points nos. 2, 3, 6, 8, 9 and 11 also apply to Extra Cancer Benefit , plus the following:

(1) Any Cancer occurred within 60 days after the Effective Date of Coverage;

(2) Cosmetic or plastic surgery (except reconstructive surgery of the face and/or breast due to Cancer);

(3) Experimental or unproven treatment or procedures and its related medical condition or complication;

(4) Genetic testing or any treatment undergone based on genetic test results;

(5) Preventative screening or checkups; vaccines for the prevention of Cancer;

(6) Any treatment modality undergone without a definite diagnosis of the presence of Cancer

This document contains general information, is for reference only and does not form part of the policy. Please refer to the policy document for benefit coverage and exact terms and conditions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: (852) 2533 5555.