As a successful and affluent individual, you live a discerning lifestyle, paying close attention to every detail. You appreciate that “good health” is your most important asset, as this is what enables you to aim higher and to live your dreams.

MassMutual Asia’s Prestige MediCare is a one-stop medical insurance solution for the discerning individual. In the unfortunate event of your falling ill or suffering injury in an accident, the plan enables you to receive prompt, quality medical treatment, giving you total peace of mind as you recover and get your life back in order.

Full Reimbursement up to $30,000,000

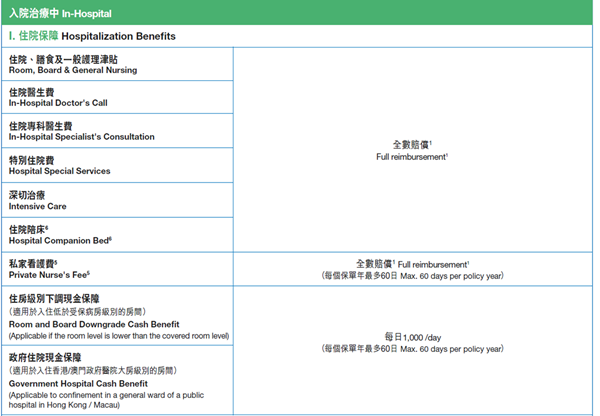

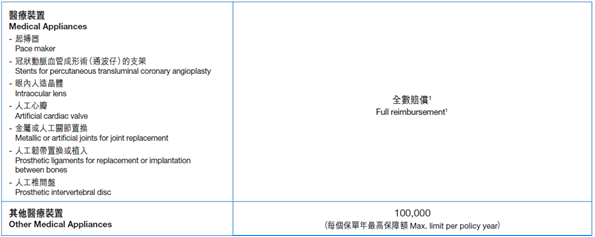

Prestige MediCare provides full reimbursement of the actual expenses incurred before, during and after your in-hospital treatment, due to sickness or accident, without any limit on individual benefit items. The plan also offers a number of extra benefits, rehabilitation support, and extended benefits as well as worldwide emergency treatment and assistance. Under the plan, you can enjoy a maximum lifetime limit of HK$/MOP30,000,000 and an annual limit of as much as HK$/MOP10,000,000.

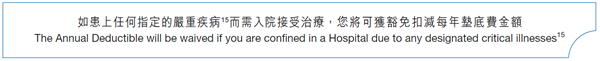

Annual Deductible Options for Your Selection

No matter whether you are planning to take out a new hospital plan or top up your existing plan, Prestige MediCare is the ideal solution. The plan offers four Annual Deductible options to suit your needs: the higher the deductible, the lower the premium.

• HK$/MOP 0

• HK$/MOP 15,000

• HK$/MOP 30,000

• HK$/MOP 100,000

You may change to a lower Annual Deductible before the policy anniversaries on or after your 50th, 55th, 60th or 65th birthday14 without having to submit any satisfactory proof of insurability. The premium thereafter will be adjusted according to the Annual Deductible selected.

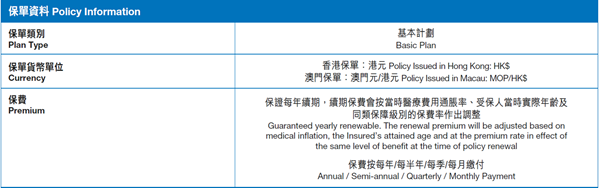

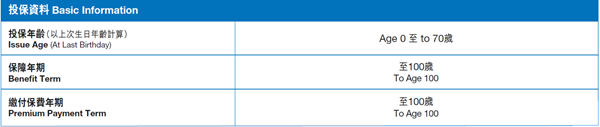

Lifetime Guaranteed Renewal plus Whole Life Protection up to Age 100

Prestige MediCare guarantees annual renewal up to age 100 regardless of your health condition or claim records, allowing you to enjoy total peace of mind. Renewal premium will be adjusted based on medical inflation, attained age of the Insured and at the premium rate in effect for the same level of benefit at the time of renewal.

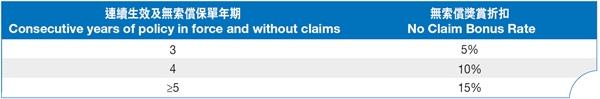

No Claim Bonus

Provided that the policy has been in force for three consecutive policy years and no claims were made under the plan, you will be entitled to a No Claim Bonus discount upon paying the renewal policy premium. The discount is based on a percentage of the annual premium for the preceding year, up to a maximum of 15%.

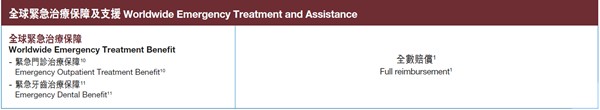

Worldwide Emergency Assistance Benefits

The plan offers free “Worldwide Emergency Assistance Benefits” in the event of an emergency. Instant assistance, including deposit guarantees for hospital admission and emergency evacuation, is made available through Inter Partner Assistance Hong Kong Ltd.

Life Protection

In the unfortunate event that the Insured passes away, a death benefit of HK$/MOP80,000 will be paid.

Remarks

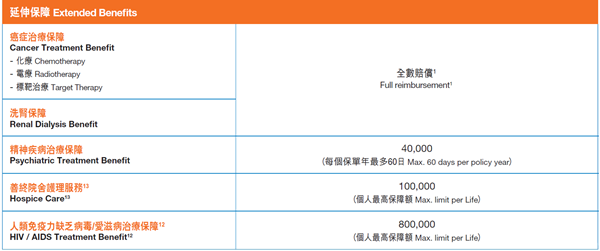

1 Applicable to treatment and surgical procedures that are Medically Necessary. Reimbursement will be made on a “Reasonable and Customary” basis, i.e., the charge does not exceed the general level of charges in the locality.

2 Applicable to the charges actually incurred in connection with the Insured’s consultation with a Doctor on an outpatient basis (subject to one visit per day) within 31 days preceding the Insured’s Hospital Confinement or the outpatient urgical procedures.

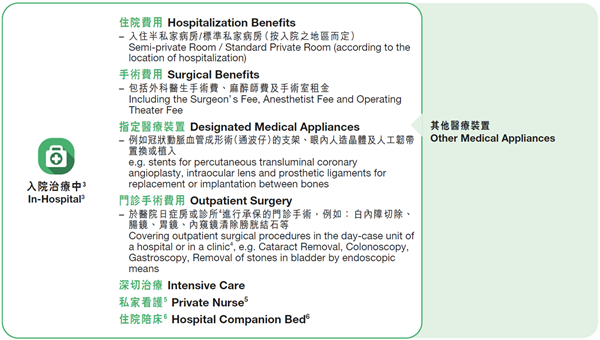

3 To keep the plan as economical and affordable as possible, “Hospital” refers to an entity which provides facilities for major surgery and full-time nursing service and is not primarily a convalescent or nursing home, rest home, home for the aged, a place for rehabilitation for alcoholics or drug addicts, or for any similar purpose.

4 The Company reserves the right to determine the eligibility of a clinic.

5 Nursing services provided by a Qualified Nurse following surgery or the Insured’s discharge from Intensive Care Unit and while the Insured is still Confined in Hospital. It must be recommended by the Insured’s attending Doctor and arranged by the Hospital. This benefit is subject to a maximum of 60 days per policy year.

6 Subject to one extra bed.

7 Applicable to the charges in connection with the Insured’s consultation with a Doctor in respect of the same Disability on an outpatient basis (subject to one visit per day) within 60 days following the discharge from Hospital or the outpatient surgical procedures performed.

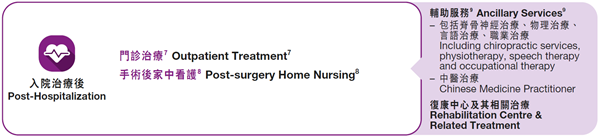

8 Nursing services provided by a Qualified Nurse at home within 60 days immediately after the Insured’s discharge from the Hospital following surgery or admission to the Intensive Care Unit and upon the recommendation by the Insured’s attending Doctor. This benefit is subject to a maximum of 60 days per policy year.

9 Applicable to any treatment performed on the Insured (subject to one visit perday) for the same Disability for which the Insured has been Confined in Hospital or undergone outpatient surgical procedures, and which takes place within 90 days immediately after the Insured’s discharge or the surgery and upon the recommendation by the Insured’s attending Doctor.

10 Applicable if the Insured sustains an Injury due to accident and receives outpatient treatment in the outpatient department of a Hospital within 24 hours.

11 Applicable if the Insured sustains Injury as a result of an accident and receives emergency treatment within 2 weeks of the accident, which is necessitated to tooth/teeth which was healthy natural right before the accident. This benefit will be paid for dental treatment performed in a legally registered dental clinic or Hospital including consultation, staunch bleeding, x-ray, tooth extraction and root canal work. This benefit shall not pay for any restorative treatment, the use of any precious metals and orthodontic treatment. It shall not cover any treatment for Injury caused by eating or drinking, damage caused by normal wear and tear, or damage caused by tooth brushing or any other oral hygiene

procedure.

12 Applicable only if the signs or symptoms of the illness first occur after the policy has been effective for five years continuously. This benefit is only payable once and the maximum amount payable is HK$/MOP800,000.

13 This benefit will be paid if the Insured stays in a registered hospice following a diagnosis, in the opinion of a Doctor, is highly likely to lead to the Insured’s death within 12 months of such diagnosis. This benefit is only payable once and the maximum amount payable is HK$/MOP100,000.

14 Request for reduction of the Annual Deductible must be submitted in writing before the policy anniversary on or immediately following the 50th, 55th, 60th or 65th birthday of the Insured. This option can be exercised once only and is irrevocable. Claims in respect of a Disability occurring after reduction of the Annual Deductible shall be subject to the reduced Annual Deductible.

15 Designated critical illnesses include Later-stage Cancer, Cardiomyopathy, Chronic Liver Failure, Chronic Lung Disease, Coronary Artery Bypass Surgery, Fulminant Viral Hepatitis, Heart Attack, Heart Valve Replacement, Kidney Failure, Major Organ Transplantation, Parkinson’s Disease, Pulmonary Arterial Hypertension, Rheumatoid Arthritis, Stroke, Surgery to Aorta and Terminal Illness.

16 Any Medically Necessary emergency treatment anywhere in the world for an Emergent Condition caused by Sickness or an Injury due to accident of the Insured during the trip of the Insured, given the lnsured resided in the place of such incident for no more than 60 days in the past 365 days from the date of incident. Emergent Condition means an unexpected condition that is acute in nature wherein the initial sign and symptom, and the consultation or treatment for this condition cannot be and are not separated by more than 24 hours.

17 Applicable to territories in Asia, including Hong Kong, Macau, China, Australia, New Zealand, Taiwan, Japan, Singapore, Thailand, Malaysia, Indonesia, the Philippines, Vietnam, South Korea, North Korea, India, Bangladesh, Bhutan, Brunei, Cambodia, Kyrgyzstan, Kazakhstan, Laos, Maldives, Mongolia, Myanmar, Nepal, Pakistan, Sri Lanka, Tajikistan, Timor-Leste, Turkmenistan, Uzbekistan and Afghanistan.

The above contains general information and is for reference only. It does not form part of the policy. Please refer to the policy document for benefit coverage, exact terms and conditions and exclusions. For enquiries, please contact our consultants, franchised agents or brokers, or call our Customer Service Hotline: Hong Kong (852) 2533 5555, Macau (853) 2832 2622.